With revolutions all across the Arab world, riots spreading through Europe, and the continued persistence of the economic downturn, it seems like everyone’s coming to the consensus that perhaps the situation has become so unthinkably bad that previously unthinkable solutions might be necessary. Government solutions to catastrophic economic collapse have rarely been neat or pretty, but at least in the past they tried to do something bold and mostly succeeded — as opposed to our modern Congress who apparently can’t even agree on the fact that they are responsible enough to spend any money.

So how about we propose a tiny, modest, infinitesimal alteration: just overthrow the whole f’n thing and start from scratch. After all, it’s the young, well educated millennials that are getting the hardest shaft from the downturn, and it’s the young, educated and unemployed who start revolutions. There’s not much else that will kick off a revolution faster than grinding poverty and an excess of free time, especially when you add in upward of $100,000 in student loan debt, piled on in pursuit of what ended up being an empty promise given by baby boomers who have their healthcare paid for by the government, but pale with horror when their children demand the same. So whether we completely re-write the Constitution (which we can totally do by the way), or violently storm the capital, here are 10 ways in which overthrowing the government would help get the economy back on its feet.

(Disclaimer: Many of the options on this list are severe, morally repugnant and hilariously infeasible. They are presented only as a meditation on how extreme current worldwide economic and political conditions have become.)

Reduce Politically Sensitive Government Spending

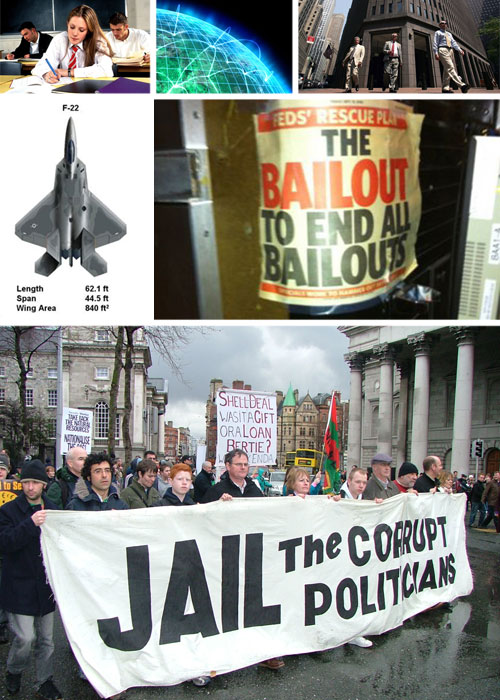

Take a look at this beauty. That’s the F-35 Joint Strike Fighter, also known as the most deadly, advanced airplane in existence today. Along with the F-22, this stealth joint strike fighter will absolutely dominate the skies for the next several decades. To give you an idea of just how good these planes are, when an F-18 pilot managed to “shoot down” an F-22 in a practice battle, everyone promptly lost their shit. And that is the only recorded “kill” of these next generation fighters. Ever. The closest competition is an unproven Chinese prototype, which no one is sure even works. Also they have one, while the US already has hundreds, plans for hundreds more, and the highly advanced infrastructure necessary to pump out even more should the need arise. Oh also for the cost of the development of the F-35 alone, we could have bought Australia.

As badass as these weapons are, ask yourself briefly: Who the hell are they going to fight? The US has been involved in two major conflicts ever since the F-22 became operational, and the F-22s have proven themselves capable by…uh…participating in a bunch of training exercises and being repeatedly grounded by mechanical defects. Even then, canceling the production was a gigantic political fight, and the fact that former Defense Secretary Gates actually succeeded was viewed as “surprising”. This was due to the fact that the program pumped trillions of dollars into the local economies of politicians who, unsurprisingly, were quite reluctant to see that funding disappear.

As it turns out, military spending (despite most people’s perceptions of the impact of WWII) is actually an incredibly inefficient use of government funds. According to most models, military spending actually becomes a net drain on the economy, especially when sustained for several years. Now imagine that the current budget and its long list of politically-motivated decisions were scrapped, and an impartial body was able to re-write the budget map. The hundreds of billions that go to these badass boondoggles could be put into, oh I don’t know, unemployment insurance, social security, health care, scholarships, or any one of hundreds of programs that actually help out those who need it most and aren’t a net drain on GDP, instead of programs that build useless nightmare machines.

Reconfigure Expensive Budgetary Liabilities

Despite the perception that most government spending is wasted on unnecessary, politically-motivated earmarks like volcano research and shrimp treadmills, the biggest budgetary problems facing the government, especially state governments, are the promises they made to the previous generation in the form of pensions, job security and generally everything nice about government jobs that people used to talk about. The problem is, it’s often encoded in law that workers are entitled to certain benefits, which turns every budget-balancing action into a gigantic battle between unions, businesses, governments and the public at large.

This inhibits governments from hiring critically needed workers both because they can’t promise the same benefits and because they can’t offer wages competitive with the private sector. And these battles ripple out through the economy, most importantly making it next to impossible to responsibly reform education. I’m not assigning blame to either the unions or the deficit hawks arrayed against them, just saying that what could be a simple problem solved productively turns into a political miasma resulting in imperfect and damaging half-baked solutions.

But if we overthrew the government, all of these agreements could be re-negotiated (since the former United States would no longer exist). The result would be painful for both sides, but the alternative of “doing nothing except arguing about it in increasingly shrill tones because everyone is too entrenched” is even worse.

Institute Effective, Responsible Regulation

While there are plenty of fingers to point as to who caused the current financial apocalypse, there’s a clear consensus among many economists that it was seriously exacerbated by ineffective regulation. Specifically, several depression-era controls were slowly and systematically dismantled through administrations Republican and Democrat alike. Why were these important and proven safeguards removed? Well, because of the disturbingly high number of former Goldman Sachs employees in the government telling people they were no longer necessary. In a revelation economists have deemed “shocking only to the half-stoned and mostly inebriated”, too much private business say in their own regulation led to useless and ineffective regulation. Even the recent Dodd-Frank reform, supposedly enacted to prevent another financial crisis like the one of the past few years, is generally viewed as being so ineffective even Chris Dodd says he doubts his own bill will prevent another crisis. And this isn’t just idle worrying about the next theoretical crisis; studies show that effective regulation (i.e. not too burdensome, but not too loose) is critical to economic growth overall.

But imagine that everyone from Goldman Sachs who suggested regulation repeals were lined up and sho– I mean politely asked to leave the room while responsible adults and experts rebuilt an effective regulatory regime. This wouldn’t be possible under the current regime thanks to Goldman Sachs’ vampire squid hold on America. But should a revolutionary government (led by the incredibly dashing and charismatic Internet writer who sparked it) take over, regulation could responsibly put in place without special-interest interference. In a saner and less autocratic scenario, a Constitutional Convention could rewrite the Constitution to include a clause where all financial regulatory reform would be proposed by an outside body of experts and subject to an up-or-down only vote in Congress. This body would be composed of appointees who would be required to have no entanglements with the financial industry.

Eliminate Harmful Market Distortions

“If it were economically viable, private companies would already be investing in it and government subsidies wouldn’t be necessary” is the constant refrain used to criticize government subsidies for alternative energy. As it turns out, pretty much… well… every other form of energy ever receives some pretty healthy subsidies from the government. In fact, the government spends quite a bit in various sectors such as energy and agriculture in the name of making the end product cheaper for the average consumer and protecting important domestic jobs. In reality, oil and agricultural subsidies are harmful for pretty much everyone from producer to employees to the final consumer.

Unfortunately, despite repeated efforts to repeal these subsidies based on their general awfulness, ineffectiveness and general economic harm, the lobbying groups behind all these industries take their billions in subsidies and promptly spend that money protecting their subsidies and scaring lawmakers with bogus economics that eliminating the subsidies would spell economic doom. Much like the previous scenario with regulation, hitting the reset button on the government would (at least briefly) weaken lobbyist control on politics and allow the repeal of these subsidies and other market distortions that are generally loathed by experts.

Reform Education and Fuel Long-Term Growth

In the current fevered debate as to the extent to which the government should interfere to help correct the economy, it is important to remember that all of the proposed fixes are meant to be short-term. No economist seriously thinks the government should make a business of bailing out the economy every year. But this raises the question of how you fundamentally generate stable, long-term economic growth. And in just about every scenario imaginable the answer is always the same: education is the key to permanent growth. It’s a truth so fundamental, economists sometimes forget to remind everyone that no fiscal trickery can substitute for a well-educated populous.

And therein lies the problem, because even taking a charitable view, from Kindergarten to a Ph.D., the American education system has some serious problems that need addressing. Primary education institutions are often poorly funded, under-performing teachers are rarely replaced, and systemic racial and economic ills persist. Higher education is prohibitively expensive, and students often spend years and tens of thousands of dollars for a degree that will not even begin to pay off their massive student debt. And again, the problems are (at least partly) structural and inextricably political. The debate on how to fix American education (or whether it is really broken at all) is long and exhaustive, but addressing the numerous long-standing and entrenched problems surrounding it could only be helped by a fresh start.

Create Less Doubt About the Fiscal Responsibility of Politicians

As much as it often seems like the value of a dollar is something hard-coded into the economy, the US dollar is a fiat currency. This means that, to greatly simplify, its value is pegged primarily to the credit worthiness of the United States. Recently one of the largest credit rating agencies, S&P, downgraded US debt rating for the first time in history, citing, in part, the political instability of the current congress. Not to mention that the instability surrounding the recent debt ceiling debate will probably cost the United States billions. Make no mistake, when trillions of outstanding debt hangs in the balance, the trustworthiness of the United States is its greatest currency.

Now imagine that you have a credit card with around a $15 trillion limit, of which you’ve used $14.5 trillion, you’ve lost your job, and you have a couple hundred billion more in outstanding payments. It may be a radical move, but in this situation it might make sense to throw in the towel and declare bankruptcy, or in America’s case, renegotiate its debt obligations. To be perfectly clear: This is an insanely extreme measure and would only be rational to implement if the US credit rating continued to drop dramatically and the world financial system was in complete worse-than-the-depression freefall. But if things (dear god) got any worse, complete overthrow of the government and a bottom-up reform of the financial system and fiscal controls would suddenly move from the realm of “conspiracy theorist chattering in his basement” to “well maybe us normal people should think about this.” This is how insane the world has become.

Remove the Politics from Bailouts and Stimulus

Not even the most die-hard Keynesian likes bailouts or stimulus plans. When a government has to resort to these methods, it means something has gone seriously wrong. On top of that, bailouts and economic stimuli create a series of moral hazards and perverse incentives, and we know politicians are just the first people we want handling issues that require a dispassionate, even hand. Hell “Moral Hazard” and “Perverse Incentive” sound like descriptions of Congress on a particularly scrupulous day.

Long economics lecture short: Bailing out companies that have behaved irresponsibly creates incentive for them and their peers to behave irresponsibly in the future, as they suffered few to no negative consequences. But not bailing them out can mean the economy will lose hundreds of billions of dollars it might never get back. (Lehman Brothers, a firm you never heard about before 2008, was worth around $600 billion. That’s roughly the annual defense budget of the US.) Economic stimulus is a recipe for crony politics, earmarks, and billions of dollars spent on things that will have no effect of the short-term health of the economy. Good luck wrestling these powerful and lucrative tools from the hands of Congress without a total overhaul.

Ideally speaking, these tools would be automated so that no last-minute manipulation would occur. A perfect example is unemployment insurance, which serves as a natural stimulus when times are tough, then automatically reduces its cost once things improve. Bailouts could be on the table only when the country is in the midst of a recession, and then would be tied to Constitutionally-mandated reforms of the company that will slowly and responsibly dismantle it — as the company has proven that it cannot be managed dependably enough to justify its size and concomitant threat to the larger economy as a whole. But unless these measures are taken out of the hands of day-to-day politics, the incentive is too great for politicians to grab the reins and either stimulate and save irresponsibly, or worse, not intervene at all as wealth evaporates by the trillions.

Reconfigure Obligations Abroad

The US has spent the better part of the past two hundred years getting its hands dirty in just about every international mess imaginable. Not even mentioning the couple trillion-dollar price tag of the wars in Afghanistan and Iraq, these interventions have been ridiculously expensive (the recent Libyan intervention cost $600 million — for just the first week).

To a certain extent, these are necessary and justified interventions in the interest of fostering global security and stability. But as the US sees its larger role and prestige decline, and more and more world powers emerge, perhaps its time to rethink this big brother mindset. The problem is, trust is currency both economically and in international politics. The US cannot just abandon its international obligations because it becomes inconvenient, without losing all credibility and standing abroad. But overthrow the current system, and old obligations and friendships will suddenly become open to reconsideration and renegotiation. It’s not a morally appealing option (pretty much nothing on this list is), but as a last-ditch option to divert more badly-needed funds back to America, letting the rest of the world shoulder more of the burden for their own local and regional security and stability becomes a more attractive option by the day.

Create Some Serious Old-School Stimulus

There is a healthy, long-running debate among economists as to what sort of stimulus programs, if any, are effective and to what extent they are effective. If you’re looking for an afternoon of lively, spirited economic theory, simply type the words “Keynesian + Stimulus + Effective” into Google and prepare to lose any remaining hope. The truth for millions of unemployed and underemployed workers is that some sort of bold solution was needed about 18 months ago. After all, the common wisdom is that World War II pulled the world economy out of the gutter, perhaps something of that scale is needed to jar the current economy out of its lethargy.

Obviously a devastating world war is not the ideal solution, but a government program that employs millions at a decent wage, and then pays for their college education after a term of service might just do the trick. Now think about getting a program like that through the current congress or any congress going back 30 years and enjoy a good laugh. Bold solutions have become impossible in the “Got Mine, Fuck You” era that’s become horrified that a single person will receive some undeserved compensation, despite any possible benefits. A government overthrow by the over-educated, unemployed, and disaffected millennials; the hard working middle class that has seen virtually no real wage growth for decades; and all those who are frustrated by a government that seems intent on preserving the status quo instead of pursuing daring and intrepid goals just might be what is needed to snap both the government and the world economy out of its current paralysis.

Because Why the Hell Not?

Maybe the worst of the Doomsayers are right. Maybe capitalism is fatally flawed and has reached the end of its usefulness. Maybe it just needs a free-market libertarian shot in the arm. Maybe Congress is fundamentally broken and needs a good retooling. The arguments that something radical needs to be done to address the unprecedented level of this recession and the subsequent inability of Congress to fully address the issues are growing increasingly numerous. On the other side, arguments for continuing as we have are conspicuously absent and have a somewhat hollow ring and tainted luster to them.

A violent overthrow or even a period of cantankerous civil unrest will almost certainly create more problems than they solve. Creating a government from scratch is several degrees of magnitude more difficult than tearing one down, but in the face of trillions of dollars in debt, record unemployment, a stagnating recovery, instability in worldwide markets, and a government that seems practically immobile… you know, why the hell not? Do you have a better answer? Please?