An ancient piece of common wisdom says the poor get poorer and the rich get richer (in fact it’s as ancient as the Bible). We’ve all experienced this in small ways in our daily lives in the form of bank fees if our account falls below a certain minimum amount, or in the higher interest rates we pay on a loan given the fact that we don’t have a yacht to put up as collateral. But lately it seems like this proverb has shifted to “the poor get poorer and holy crap don’t tax the rich — who else is going to generously provide menial minimum-wage jobs to the poor?!”

In case it doesn’t go without saying, being poor is really super awful in ways most people fail to think about. Well, “most people” might be stretching it, since statistically speaking, the percentage of Americans living in poverty is at its highest point in more than a decade, not to mention that the poverty line is $22,350 for a family of four. Try supporting just yourself on that and see how not poor you feel. So for the sake of re-affirming the obvious, let’s dive into the actual reasons why the poor stay poor in America.

The Poor Stay Poor (Without Some Sort of Intervention)

As a starting point, it’s prudent to examine the basic truth behind this proverb: do the poor really stay poor as the rich get richer? As its known in economics, “per-capita income convergence” is both well-studied and frustratingly inconclusive. A good way to think about how this question is studied in economics is to ask the why did the per-capita income of Asian countries (speaking generally) converge to the level of first-world Japan in the 80s and 90s while Mexico still struggles to raise its standard of living, despite residing next door to the largest economy on Earth? Now imagine we’re asking the same question about the North and South sides of Chicago, or Whites and Blacks in America.

The short answer is that the proverb is wrong, per-capita incomes do, in fact, converge given time — which isn’t at all surprising if you were awake for the 20th century. There are two important caveats to this answer, though. The first is that while the rate at which incomes converge can be as fast as 25% per year, they can also be as low as 1% (i.e. the poor will stop being poor sometime around the year 3000). This rate depends primarily on the similarity of conditions in the two groups being observed — the more they have in common, the more easily the poorer group is able to take part in the larger group’s wealth. The second caveat is that buried in these economic analyses are several assumptions about government policy, the development of human capital and the legal system. Without these (often very vague) assumptions, per-capita incomes actually do not converge.

So where does this leave us in the question of whether the poor get poorer and the rich get richer? Absent proper government intervention and legal protections, it looks like the proverb is true. And, examining the shocking growth in income inequality in the United States, it seems reasonable to infer that America is keeping the poor poor and the rich rich through simple inaction.

No Jobs for the Middle Class

Before the inevitable debate over what has caused rising income inequality in the US over the preceding decades, it’s important to be aware of the fact that it’s as much of a reflection of the bifurcation in labor growth as any systemic inequalities. The post-manufacturing economy in America has unfortunately created most of its jobs in either astronomically high-paying positions, or pitiably low-paying positions.

For the past 30 years, you either became a lawyer or a short-order chef. Without any middle-class manufacturing jobs that paid a livable wage while requiring minimal education, millions of Americans slipped into minimum-wage-or-slightly-above positions. Not only did this deprive them of the added income, but it also slashed benefits such as health insurance, retirement & pensions, and continued education which indirectly contributed tens of thousands of dollars to households’ bottom line.

The big question that rarely gets asked on either side of the ideological spectrum here is: if the economy is still growing, why aren’t conditions improving for everyone? Though the high-powered lawyers are capturing a disproportionate slice of that economic growth, it’s not like they aren’t spending that money. Couldn’t the newly disenfranchised middle class respond by growing into industries that capture all that trickling down? Well remember the thing where income convergence depends on the proper development of human capital? What that’s basically saying is that the high-earners may pour their money into yachts and houses in the Hamptons, but the poor machinist trying to change jobs has no way to pay for, much less time to attend, mansion-building classes at the local community college without some sort of aid. And the government has responded by…uh…

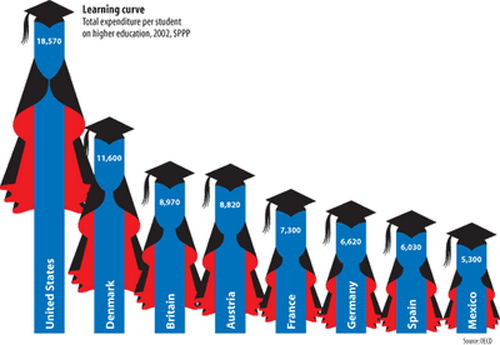

Not Supporting Higher Education

At a time when America’s work force desperately needs a way to respond quickly and intelligently to a fast-moving high-tech economy, higher education has become more financially inaccessible than ever. On average, there is no good in the economy growing faster in price than higher education (it’s even beating out healthcare). When wage growth itself is barely keeping pace with inflation when the costs of higher education are consistently outpacing it, you have a recipe for a persistently poor, under-educated and under-employed workforce.

So what could be done to address this? Well in comparative first world countries (such as Canada), the cost of higher education is growing at a much slower pace, barely beating inflation year-to-year. The main difference here is Canada heavily subsidizes students seeking higher education, possibly accounting for the vastly different cost structure. Of course this isn’t an answer to how to fix higher education in the United States, that’s a vastly different and heated debate. But if you want to know why the wages of almost everyone outside of the top quartile aren’t rising, it’s part of the answer.

The Poor and Uneducated Tend to (Surprise!) Make Bad Decisions

To preface, let’s keep in mind that being born uneducated and living in an environment where knowledge of the formal economy, and how to prosper financially therein is sparse to non-existent, is not an individual’s fault. We’re not blaming the victim here, but in understanding the machinations of how poverty persists so virulently, it’s worth nothing that the impoverished do some really stupid things to perpetuate their situation.

The list is long and sounds like Ronald Reagan’s wet dream, but is nonetheless true:

• Only 30% of those making less than $25,000 a year think they can accumulate $500,000 through saving and investing

• As much as 45% think the most likely way to do this is winning the lottery

• On average they say they can’t afford health insurance or investing in a 401k, and yet spend as much as $4,000-$6,000 a year on lottery tickets and cigarettes (which, by the way, would net over a million dollars by retirement in a decent 401k)

What should be done about this is pretty obvious. Funding a physics Ph.D. is one thing, but basic personal finance education should be an easy and incredibly cost-effective solution. The problem is, it’s not just poverty and a lack of education that create persistently poor underclasses, it’s also how persistent poverty creates a self-perpetuating cycle within the impoverished classes themselves, and a resistance to education that has little to no relevance in an area that operates primarily outside the bounds of the formal economy.

Lack of Reproductive Care

When it comes to affordable access to reproductive healthcare, America lags behind many other developed countries. To be clear, no judgment whatsoever is being passed here on the morality of abortion, birth control, sex education or reproductive care in general. But if we’re going to talk about what keeps the poor poor, it’s impossible to ignore the facts:

1. Unplanned pregnancies among the impoverished are on the rise, and an 18-year, several hundred thousand dollar commitment is going to be a tremendous financial burden no matter which way you slice it, limiting a parent’s (or parents’) access to higher education, better job prospects, or increased income of any kind

2. The health cost incurred by even a mild STI (not to mention something more serious, like HIV) is likewise a large financial burden

3. People are simply not going to stop fucking

While this somewhat also falls under the category of “things that impoverished, uneducated people do that perpetuates their situation” it is also similar to basic personal finance knowledge in that a little bit of education, as well as affordable access to birth control, reproductive healthcare, sex education and, yes, abortion would seriously diminish this financial burden on the already impoverished, to the tune of at least $11 billion per year in direct medical costs alone. And before someone talks about women having babies just to collect more welfare, just shut up. Maybe if the average number of recipient children was above 1.8 per household and falling, there might be a point there, but for now just shut up.

It’s Exceedingly Difficult to Get Decent Credit

Credit is the lifeblood of any first-world economy, and it’s something that most Americans take even the simplest forms of for granted, be it a credit card, a high credit score, or a credit score at all. For most Americans living in impoverished neighborhoods, there are three possible options for financing: pawn shops, payday loan stores or banks that are likely to charge rates that even Shylock would consider usurious. When you’re consistently paying in excess of 20% higher interest rates than the average consumer, it’s incredibly difficult to get ahead, to put it mildly. And making these outlandish payments makes it difficult, if not impossible to establish good credit — especially because many of those living in poverty rarely have enough money on hand to afford the fees associated with a checking account. This forces most of those living in poverty to deal strictly in cash, which prevents them from establishing any credit to begin with (which is often worse than having bad credit).

This is especially important because credit is virtually the only way to make those big investments that generally allow people to make a jump in income class. Even upper-middle-class families need loans to attend college, pay for medical expenses, purchase a house, purchase a car to get to work, or even something as simple as using a credit card to cover a sudden, critical expense. Not to mention small business loans or similar cash infusions that fuel local economies. But because it can’t all be doom and gloom, the good news is that since 1977 the government has actually required banks to service low-income neighborhoods, with some success in extending affordable credit. In fact some of the fastest-growing investment sectors for banks are low-income areas. However, the act is in bad need of some updating.

Poor Public Infrastructure

If you’re under the age of 25, it’s likely that the most expensive product you’ve ever purchased is a car. And by “most expensive”, we’re probably talking an easy 10-15 times the next most expensive thing. If you didn’t need a car, that’s easily a couple hundred extra dollars in your pocket each week after fuel, insurance, registration, and repairs. Now imagine you’re at the poverty line with two kids and you make roughly $430 a week before taxes and the bus starts to become a much more appealing option. Unfortunately in America, unless you live in a small handful of large metropolitan areas, you absolutely need a car to get around.

While some of this isn’t anyone’s fault since America isn’t really as geographically concentrated as, say, Seoul, we have a long history of not giving a shit about properly funding public transit, while throwing billions upon billions at building the public infrastructure necessary to support our $50,000 odes to American independence. On top of this, mass transit, especially rail, is significantly more cost-effective in the long run than building or maintaining more roads. As if you needed any more reasons why the poor tend to stay poor, imagine everyone has a “Being an American” tax of at least $1500 annually no matter their income, and if they didn’t pay it the IRS bolts them to the ground, preventing them from going to work.

A Lack of Affordable Healthcare

Wading into a partisan debate about this issue would be pointless. Whether the private industry could meet the healthcare needs of Americans or whether the government needs to intervene is irrelevant to the facts at hand, which are:

1. A record more than 50 million Americans don’t have any health insurance; the vast majority of these are, unsurprisingly, low-income.

2. Many of those who have insurance don’t have very good insurance that will cover their bills to the extent that serious illness won’t become incredibly onerous

3. A sudden serious health condition or a chronic health condition can be financially ruinous, in fact more than 60% of bankruptcies in 2009 were the result of sudden healthcare expenses.

Unlike higher education, which is the only service that has outpaced the cost growth in healthcare, people never “choose” to incur sudden large medical expenses. And even if in the rare event a low-income family can actually pay down their hospital bills, they have no additional skills to show for it.

While the poor are often covered by Medicaid, it’s a common misconception that poverty is the only requirement. In short, it varies significantly from state-to-state, by age and disability status. But for your average, reasonably healthy low income person, you basically have to prove that you don’t have assets or savings that could be liquidated to cover your medical costs (to reiterate, this is a national generalization of a program that varies significantly across the country). An illustrative example can demonstrate why it can be so insanely difficult to emerge from poverty in America:

So say you’re a conscientious impoverished family of four that has diligently paid off your meager house and saved a small amount of money by tightening the belt for decades–fostering a dream of emerging from poverty even though income-wise you’re not even close. If suddenly you have tens of thousands of dollars in medical bills (or you know, like two nights in the hospital), say goodbye to literally everything you own.

The Informal Economy (And How the Government Deals With It)

The informal economy refers to all of those things that happen under the economic radar, ranging from drug deals to, yes, the cash you pay your baby sitter. A more technical definition is it’s all economic activity that isn’t recorded or taxed by the government. Participation in the informal economy, unsurprisingly, is particularly high in impoverished communities for several reasons. One is that it’s untaxable, meaning that much more money is able to be squeezed out of it. Another is that it circumvents the barriers to entry of the formal economy such as credit, education, or a lack of a criminal record, to name a few. But one of the most salient is that it allows the sale of high-margin goods (read: drugs), something those living in low-income communities would otherwise almost never have the ability to do.

The problem is, the minimum sentencing guidelines instituted during the “War on Drugs”, are pretty much universally viewed as being absolutely insane by everyone but scared housewives and Ronald Reagan’s corpse. It’s not that everyone is weeping over those poor drug dealers; it’s that sentencing someone to a minimum of 5 years for 5 grams of crack cocaine is completely ineffective in fighting the sale of crack cocaine, and actually increases that person’s likelihood of recidivism. To get an idea of how big of a problem this is, more than 20% of prisoners in America are non-violent drug offenders, and America currently beats out every other country on Earth for total prison population. This includes China, you know, that brutally repressive regime with four times our population.

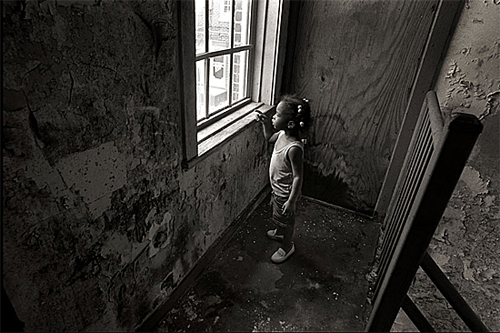

It’s a Race Thing, Okay?

I know we all just wish we could put this behind us, move on from the sins of the past, and enter a happy, harmonious color-blind society. But the truth is, it’s insane to talk about poverty in American and not talk about the fact that, oh I don’t know, the average net worth of a White person is 20 goddamn times that of your average Black person. The painful truth is that when you’re talking about populations that stay poor in America, you’re talking about minorities.

The discussion of why minorities are so systemically impoverished could fill volumes of history, sociology, and economics texts for decades. To boil it down to its (insanely simplified) essential details: due to extreme historical discrimination and segregation, the majority of minorities were forced into ghettos and then cut off from the formal economy. In the interim they, by necessity, developed a unique economy, culture, and social norms. Now remember point number 11 above? Areas of different per-capita income tend to converge faster depending on how similar they are, which is basically a proxy for how easily they can interact with the larger, wealthier economy. Now walk to the south side of Chicago, the South Bronx, or pretty much anywhere in Detroit and think about how easily those neighborhoods would integrate with an upper-middle-class suburb. Now ask yourself how long it would take to integrate these two societies given that they were violently divided for centuries. Now get depressed. Now stop worrying because at least you aren’t stupid enough to think that:

Poor People Are Poor Because They Are Lazy