Image: Alex E. Proimos/Flickr

What makes you stop trusting a company? Was talking to their customer service people akin to having a conversation with a brick wall? Do your bills more closely resemble Pandora’s Box than something you can actually pay? When you try to resolve things with the company, do they suddenly become slippery?

These things and more can make any sane person stop trusting a brand. Sadly, many companies still choose bucks over good behavior, especially if they operate in monopolistic or oligopolistic market conditions. Here are 25 of the least trustworthy brands of the past decade.

25. Comcast

Image: D.C. Atty/Flickr

Comcast isn’t exactly an Internet connection provider you run towards. They have a labyrinthine pricing structure subject to change at anytime—ever been caught with a $70 monthly bill after your promotion runs out?—service centers that rival the DMV in terms of warmth, and connection speeds the company will almost always tell you are working fine, even if it takes 10 minutes for your email to load. Comcast has cornered the “big and everywhere and omnipotent” theme, so consumers, bereft of choice, keep signing up.

24. United Airlines (US Airways, Continental)

Image: drmcmartin/Wikimedia

Depending on the flight, the United experience can range from decent to exquisitely bad. Yet customers, including myself, keep booking because they often offer the best prices. I’m almost reverential, because in all my years of traveling, only United has:

* Overloaded a 737 in Mexico City to the point that the plane tipped over (12 hours delay).

* Flown from Vancouver to San Jose with a small hole in the wing.

* Diverted a full San Diego-bound flight to LAX, then left us stranded at LAX overnight without hotel or shuttle access. The pilot, before leaving my home airport, announced on the PA: “Well, folks, I have to see my family for Christmas, too.” So I’m just gonna drop you off, suckaz!

* After my luggage went MIA one New Year’s eve, a United representative told me, without blinking, that “we’re part of a union, and we don’t really care. So don’t expect too much.”

* United actually lost my friend’s mom. She was on her way to India, and they screwed up her connection in Chicago to the point that she had to re-book the flight and prove she’d actually booked it in the first place. I’m duly impressed that United can lose humans as well as luggage, which they lost for her after she arrived in India, too.

I’ve met some really nice flight attendants and talented pilots on this unwieldy beast of an airline. That fact that they’re getting even bigger now, in the wake of the United-Continental merger, doesn’t give me much hope, however.

23. Orbitz

Orbitz may have good travel deals, but they seem to be on vacation when it comes to customer service. Saving money by cutting customer service staff and outsourcing what little they have left to people with limited training (and probably low pay, too) does not yield good results. One such outcome is that Orbitz has a reputation for not admitting its own mistakes. Customers complain that they don’t get clear information after booking, either, and that Orbitz customer service is about as pleasant to deal with as a rattlesnake on a hiking trail. Bonus: Other complaints include being charged multiple times through the Orbitz website and not actually insuring you through their “travel insurance” programs. Yowzas.

22. AT&T

Sluggish repair service, billing practices that make you say “Huh?”, sneaky fees, impossible-to-reach customer service, and the cherry on top of dropped calls make AT&T a favorite for customer complaints. Many utilities companies get away with straddling mediocrity when it comes to being loved by consumers. Still, that doesn’t make it right.

21. Verizon

“Can you hear me now?” Many a customer has wanted to say this when begging Verizon to clarify their mysterious charges. You often need to spend an hour or more parked at your local Verizon store just to figure out the basics of how your plan works. They used to sneak in texting charges, but a class action lawsuit stopped that. Now they gouge you when you go over your texting and calling allowances (to their credit, they have started texting you warnings before you go into 10-cents-a-line territory). Their phone reception is good, but they could definitely be more receptive to customers’ needs for transparency.

20. DirecTV

Image: Bisteca/Wikimedia

Word on the street is, you pay for using DirecTV. Not just the usual monthly fee, but equipment fees, contract cancellation fees, fees for equipment you never actually had, fees for contracts you never signed, fees for their mistakes, and fees for your fees. Why a company whose brand appears in your living room every time you turn on the tube would choose to associate itself with that much frustration is beyond me. It seems that someone decided cutting out decent customer service was a good idea. Word to the wise, it’s not.

19. Citibank

Image: Uris/Wikimedia

As with other big banks, loyal customers don’t seem to count in the eyes of this behemoth, known for doubling credit card interest rates at whim, canceling other cards without warning, sketchy recordkeeping, and an unresponsive fraud department, to name a few. But if this bank really is a zombie, why expect soulful behavior?

18. Bank of America

Image: Brian Katt/Wikimedia

Another member of the Wall St. bailout herd, BofA has the cash flow to make their customer experience smoother, but you wouldn’t know it, possibly because customer fees are the bank’s flow source. That, and government bailout money, funded by…citizen fees. The circularity is mind-blowing. (If you need details on exactly what they do wrong, there’s an extensive forum dedicated to that cause).

17. Facebook

Image: denneyterrio/Wikimedia

On software that requires your real name and email address, and which you use for personal updates, you’d expect something akin to respect for privacy. But Facebook, with its sneaky default settings and ever-changing ideas about what confidentiality means, reflects anything but a respectful attitude. Perhaps the silliest thing about it is that everyone keeps using it, despite the fact that founder and CEO Mark Zuckerberg has said that the “age of privacy is over.” Shame on them–and us.

16. American Airlines

Image: Brian/Wikimedia

Yet another casualty of big-airline syndrome, American isn’t exactly celebrated for its service or on-time flights. They also seem to have a knack for getting stalled by mechanical problems after everyone has boarded the plane. And if their mechanical problems make you miss another flight which you then have to rebook, you’re in airline jungle hell, as adeptly described here.

15. Delta

While each of the ‘three stooges’ airlines on this list flaunts mediocrity like a banner, each also has a special niche that really puts the “sucks” into their jet engines. American has its mechanical delays, United’s ramshackle beast of an organization makes packrats look methodical. Delta, it seems, specializes in Guantanamo-level customer service. Losing count of customers on a plane, delivering baggage damaged, dirty and wet, and flipping your seat on a plane to another customer without your knowledge are just a few complaints angry customers have posted online. The overarching theme in all of them is that Delta staff basically treat customers like inmates, without any guarantees that said passengers will arrive at their destinations anywhere close to on time.

14. Time Warner Cable

Shipping faulty cable boxes, so-called past due balances with epic backdates, tardy technicians, spotty service. These complaints and more orbit around Time Warner’s servicesphere. This all might have something to do with Time Warner’s messy identity crisis: Merge with AOL, see ship start to sink, divest Time Warner Cable, diversify to Chile, claw at the walls to stay organized while befuddling customers. One can only hope that the newly independent Time Warner Cable is on a learning curve and will, with increased competition from online viewing, focus more on providing a good experience for customers.

13. Circuit City

Image: Tom Raftery/Flickr

Shoddy service, lofty restocking fees, squirrely exchange policies. These perks and more defined the shopper experience at Circuit City, which has gone online-only since liquidating its stores. I suppose all those customer complaints didn’t exactly give it a competitive advantage in the brick-and-mortar space.

12. Wells Fargo

Image: Coolcaesar/Wikimedia

Better put on your running shoes before you deal with Wells Fargo, because chances are, it’s going to be like an obstacle course. Jump through hoops to cash your check, clear all the hurdles around transferring money, avoid slipping in the mud as they change your loan modifications on you with minimal notice. Wells Fargo will brandish a fly swatter at customers and expects them to skulk out without complaining. And that, my friends, is why Internet discussion boards are full of such complaints.

11. JPMorgan Chase

True story. A friend of mine—call him Michael–called Chase bank to check his account balance and the customer service rep informed him that he didn’t have any money with them. Michael had to argue with the rep and go through a host of security questions to reassure the rep that he actually had a Chase account. The rep then admitted that whoops, yes, Michael actually did have an account. I ask of you, how trustworthy is that, calling your bank and having a stranger tell you that you’re wrong about your account info? Add to that Chase’s sneaky fees, questionable in-bank customer service, and its eminent position on Wall Street’s bankster lane, and you have one money cache of questionable trustworthiness.

10. Walmart

Image: galaygobi/Flickr

It’s the cheapest megamarket in town (and the next town, and the one after that). The companies on this list have proven that if you chase rock-bottom prices, you’ll generally also get bottom feeder service. Walmart, which does precious little to motivate its low-pay employees to be good service providers, is no exception. The thing Walmart has going for it is price. Do you walk into one of their superstores expecting good service, clean bathrooms, a pleasant shopping experience that makes you want to linger? Not really. Do you count on their products to last a long time? No. Do you come in expecting to pay less than anywhere else? You betcha. And this is why the disgruntled masses keep coming.

9. Pfizer

Image: Erich Ferdinand/Flickr

Distrusting a pharma company is a mixed bag. On the one hand, they produce quality medicine that might save your life one day, or at least, in Pfizer’s case, your erection. On the other hand, big profits breed size, which breeds bureaucracy and lust for power, which in turn opens peepholes for corruption. All of a sudden, the same company that’s selling lifesaving medicine is embroiled in litigation, testing formulas illegally, and spilling toxic ooze into the environment. Medicine that holds so much promise has mutated into a mess. Talk about a bitter pill.

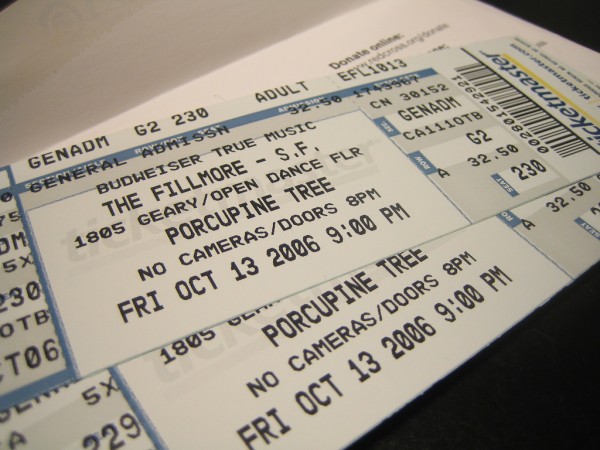

8. Ticketmaster (now Live Nation Entertainment)

Image: Rick/Flickr

The company formerly known as Ticketmaster seems to have taken a hint from our banking system as to how to make money. That is, they jack up fees and service charges to obscene amounts just so their poor sods of customers can go see the artists they love. In some cases, the markups are almost half the ticket price. As with most gougers, Ticket Overlord—err, Master–harnesses a monopolistic market in which they’re the primary ticket seller for most professional sports teams, major musicians, etc. With their recently introduced “dynamic pricing,” Ticketmaster is ensuring that it scoops up all the profits it can, even from lower-selling events. They also opt you in their marketing program and make it nearly impossible to opt out. Luckily for everyone, competition in the online ticket space is heating up, so these fat cats might have some real competition soon.

7. Assurant Health

Image: Erich Ferdinand/Flickr

If, God forbid, a meth dealer fleeing the fuzz were to broadside you in traffic one day, causing brain trauma and other serious injuries, you’d think your health insurance would cover that, right? Not Assurant (or Time, as they’re also known). When this very accident happened to Colorado’s Jennifer Latham, Assurant denied her claims based on a Joseph Mengele-ian rescission that claimed she hadn’t properly disclosed an ER visit for a panic attack and a uterine condition in her insurance application. How this relates to Assurant’s inability to do its own job is anyone’s guess. A jury nailed Assurant with a $37 million fine after the case went to court, but that’s still raindrops in the bucket compared to the more than $150 million Assurant has saved through rescissions over the years, according to the Denver-based indy newspaper Westword. Sadly, the business model of ripping off anyone who doesn’t know any better (or isn’t a professionally trained health bureaucrat) continues to be standard practice for both Assurant and its health-conglomerate compadres.

6. BP

When your oil rig explodes in the Gulf of Mexico, you probably wouldn’t go around spewing quotes about the “little people” who have been affected, or absolving yourself of responsibility in the chain of events. Unless you’re BP, of course, and you’ve engineered one of the most colossal PR failures in the 21st century. Note to Big Oil: When your earth juice spills over and starts killing dolphins, make sure people don’t hate you more than they already do.

5. WellPoint Insurance

Image: Joel Flintham/Flickr

When it comes to health care conglomerates, the question isn’t “how good is this company?” It is “how bad does this company get?” In the case of Anthem Blue Cross/Blue Shield parent company WellPoint, the answer is pretty bad. The Milwaukee Express sums up WellPoint’s version of the industry’s “bilk the ill for profit” policy:

• According to the House Oversight and Investigations Subcommittee, WellPoint rewards its employees for finding ways to drop coverage to sick policyholders.

• According to the Feb. 13 issue of the Los Angeles Times, WellPoint sent out thousands of letters to doctors looking for conditions they could use to cancel coverage for patients.

• The House Oversight and Investigations Subcommittee found that WellPoint lists 1,400 conditions, including cancer, that can lead to revocation of insurance coverage.

• The Feb. 11 issue of the Los Angeles Timesreported that WellPoint was fined $15 million for dropping coverage for thousands of members after they submitted expensive medical bills.

That’s not to mention the up-yours rate hikes they’ve sent millions of customers. Their CEO gets in excess of $9 million per year for encouraging this kind of activity. Sadly, this is standard behavior for the industry and its leaders.

4. Monsanto

Image: Spedona/Wikimedia

When a powerful group of individuals who profit off a common interest gang up on individuals and threaten them into submission, we usually refer to that as organized crime. Monsanto spies on farmers, documents their behavior, then sues the plow out of them if they’re violating the terms of Monsanto’s contract. A little slicker than the Mafia, to be sure, but with the same basic mechanics. Can we expect anything else from a company started on the premise of killing life, from insects to Agent Orange? Trust is not the operative word here. More like fear for your life and assets.

3. Goldman Sachs

Image: Jerchel/Flickr

When a popular journalist calls you a “great vampire squid wrapped around the face of humanity,” and everyone in the country starts calling you “Squid,” chances are, you’ve done something to deserve it. Goldman Sachs is the ultimate manifestation of what Umair Haque calls the “bromance” between business and government in this country. The revolving door between Sachs and the gub’mint is oily with corruption, but, with tens of billions in tax breaks and bailout money, they’re thumbing their noses at us all. The odd caveat to this all is this: Would you trust Goldman Sachs to make you money? You would, right? They’re so well-connected and corrupt, it’s almost like having a family inroad to the stash of wealth controlled by America’s upper crust. But a button man in the Mafia could also make you money by beating the crap out of someone and taking their wallet, so this isn’t the kind of trust we need to tout.

2. Corrections Corporation of America

Image: Casey Serin/Flickr

Americans are a funny breed. Our country is built on layers of immigration—after herding our original inhabitants out of sight, that is—and each generation of immigrants seems to hate the one that comes after it. If you trace back the blood lines of the (surprisingly diverse) Corrections Corporation of America (CCA) exec team and board, surely an ancestor or two snuck into the States under the legal radar. That doesn’t stop the hardworking team from sustaining an industry off corralling and enslaving immigrants. If you come to the US to work and CCA catches you, work you will. It’ll just happen in an orange jumpsuit, for pennies an hour.

1. Halliburton

Image: Jason Sussberg/Flickr

When you land a $7 billion contract in the weeks leading up to the Iraq War, and you’re the only company to bid on the contract, and the Vice President of the United States happens to be your former CEO, well, you’re not all squeaky clean, that’s for sure. Among its many questionable activities, the company has admitted to bribing Nigerian politicians. It also mixed cement that it knew had quality issues into the Deepwater Horizon rig, but was laissez-faire about passing on the info and taking responsibility. To boot, the Halliburton CEO lives and works in Dubai. That’s shady business and politics.