Oil prices are levitating; as a result, everyone is freaking out about food. Food prices, that is, which threaten to increase more (and cause riots, and shortages, and all those other fun aftereffects) as oil climbs the stairway to heaven.

I recently wrote a couple of articles for a Minyanville feature package on food prices. Here’s a sum-up of their findings on food prices:

Corn, sugar: Pray for good weather and a loss of government interest in ethanol* so that corn prices don’t skyrocket. Sugar is in a similar situation.

Meat: Due to rising prices and production constraints, chicken is set replace beef as America’s meat of choice over the next decade.

Wheat, dairy: Wheat prices look like they might actually go down. So do dairy prices. Both, however, are strongly linked to corn prices.

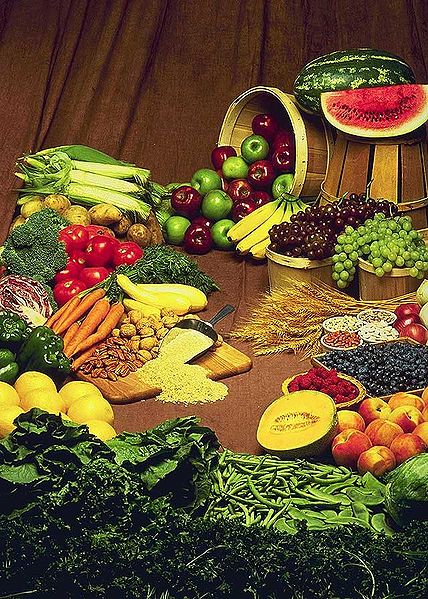

Fruit, veggies, vegetable oils (and products containing them), and even beer stand to increase.

Coffee, ironically, is in the scariest situation, if you happen to be an addict. Hoarding coffee might be a very good idea.

Minor food price increases, at the very least, seem to be in the cards for most foods no matter what the global (weather, political, and economic) climate. Spikes, as is generally the case with commodities, may or may not materialize, though coffee price hikes are pretty much guaranteed. One company, Japanese food ingredients giant Ajinomoto has had revamped its operations recently to tackle rising prices.

Are food prices worth the worry? A better question might be “how pessimistic are you?” Or perhaps “do you have a disposable cash stash, just in case?”

Taken in concert with the rate at which Americans are now using food stamps, unemployment, and the general national situation, food-price prognoses currently have me in Camp Worry.

*when pigs fly.