In today’s society using a debit card, credit card, or other digital form of payment is often preferred over using cash money. Many have never given any real thought as to how not using cash can affect different areas of our lives. These are ten of the biggest pros and cons to the double edged sword of using cards or other digital means instead of physical currency.

1. Convenience For The Consumer

For most people, using a debit or credit card is much more convenient than carrying cash. The days of, “I forgot to stop by the ATM.” are pretty much over since most bank cards can be processed as either Visa or MasterCard, which are the two most widely accepted credit cards around the world. There’s no more fumbling with change or holding up a shopping line in order to write a check. Speaking of checks, they are mostly obsolete, so many people don’t have to purchase them anymore — or find a safe storage spot to put all the empty check book stubs or duplicates.

2. Processing Companies Thrive

With the rise of use of debit and credit cards, jobs have been created by card processing companies in order to meet the demands of the swipe-and-go lifestyle many of us have grown accustomed to. The companies are highly competitive with each other and it’s not unusual for small businesses to receive calls or visits from representatives hoping to persuade them into switching over to their processor. Of course, there are also technical workers hired who have to help keep the actual processing going.

3. More Software and Tech Jobs Are Created

When it comes to digital payments there are a ton of different ways to do it and people are still developing new technology and apps to make life easier. Whether it’s PayPal, Apple Pay, Samsung Pay, Android Pay, SoftCard, or any of the many other methods of payment out there, there is someone behind the method making sure that the systems run smoothly and up to date to prevent bugs or hacker threats. Software and technical jobs are not only for the creation of apps; digital systems must be properly maintained, too.

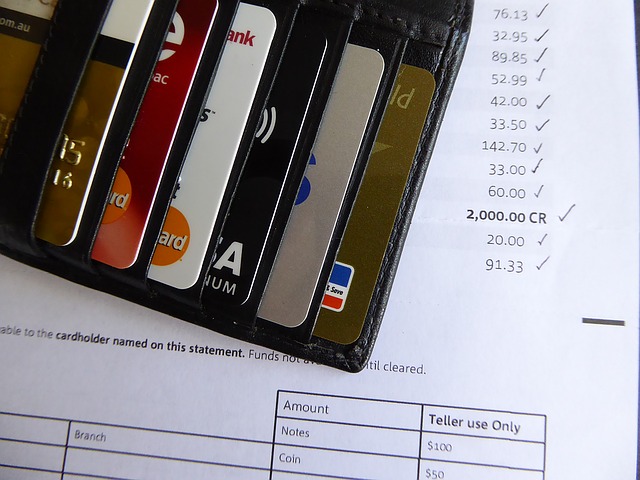

4. Easier to Track Spending

When everything is paid by card or digitally, there is a record of it, which is easy to find on a bank or credit card statement. So when tax season comes along, doing taxes can be a lot easier with all the information in one place. While you should keep receipts, if you lost one, at least the payment can be verified.

Not only that, but for some people it can keep impulse spending limited, because who wants to swipe their card for just a soda or a candy bar? Not to say it doesn’t happen, but generally people think twice about using their card for such a small item.

5. Feeling More Secure

Sometimes people with large amounts of cash in this day and age are often worried they will be mugged. When your money is all digital, it’s more difficult for someone to steal it from you. If your cards are lost or stolen it’s fairly quick to report them as such and have the numbers changed and get the card replaced. Of course, this opens up a whole new door of employment opportunities as well, because when something does go wrong with a transaction, the bank is obligated to help the customer. Also, businesses which help consumers prevent identity theft and help them correct errors or mishaps have been created and flourish.

6. Contributing to Inflation

There’s a cost to convenience. Processing companies are a double edged sword for the economy because while they do create jobs, they make money off the backs of merchants. There are often fees for each swipe as well as percentages of the total amount processed or a flat rate based on sales that is billed and usually paid through direct debit on a weekly or monthly basis from their clients. While all businesses feel the bites being taken out of each transaction, this can hit smaller businesses harder. Regardless if it’s big or small business, at the end of the day, prices are changed in order to compensate for those processing fees.

7. Sorry, We Don’t Take That Form of Payment

Those words hurt both the customer and the business. While many people have access to Visa and Mastercard, there are plenty of reasons why they may not want to use that form of payment. While Discover and American Express are highly popular cards, their customers may still find merchants who do not accept them. This may be due to the cards processing at a higher rate and merchants choosing to opt out rather than take a larger loss in processing. Regardless of the reasons, it can be really disappointing to not be able to use a specific card that has excellent perks. For the merchant, it can be equally as terrible because they are in business to make sales, and if they can’t accept that form of payment, then the sale can be lost entirely.

8. Too Much Information

While some customers feel completely comfortable signing up for a new payment app or entering their card number in at any website selling something that they want to purchase, there are others who may be more apprehensive — and with good cause. Hackers looking for credit card numbers love it when people make it easy to get the most information possible. A poorly guarded website which accepts payment or cracking a larger app that holds multiple card numbers can certainly be appealing to a criminal mind. While most payment apps will employ tech workers for security measures, choosing not to use a system that carries multiple pieces of your valuable and personal information is probably best if you’re concerned about hackers, thieves, and identity theft.

9. The System Is Down

In a perfect world this would never happen. However, in real life, businesses of all sizes experience malfunctions here and there. While generally it’s a temporary situation, it is extremely inconvenient when the system being used for processing cards has gone down and all transactions are limited to cash-only — or if it happens to be internet sales, they are not happening at all. Needless to say, this is a terrible situation. Not only does the business have to hire somebody to fix it (unless it’s an outage), but they also will be looking at losing most, if not all, of their business during the interruption.

10. Lack of Verification

When is the last time someone checked your ID for a credit card payment? While debit cards generally require a PIN number entry, they are still able to be used as a credit which does not require a PIN, but a signature instead. And if an order is placed online, the card information is generally all that is needed. There is a huge window for fraudulent activity left available for criminals with digital or swipe-and-go payments. With identity theft on the rise, sometimes opting to use a card makes you realize how much is at risk for the convenience.