Almost from the time that the CBD boom started, skeptics began pointing to the end of the boom/bust cycle on the horizon. It’s a fad. It’s a scam. It’s snake oil. It’s a pyramid scheme. And that’s even without fears that the federal government will crack down, that banks will refuse to participate, that family farmers will get squeezed out, and that foreign hemp products will flood the market.

Well, we’re several years into the turn (just by one unscientific measure, Google searches for CBD overtook searches for THC back in 2016), and for the most part, none of the naysayers have been proven right (yet). The federal Farm Bill of 2018 made hemp cultivation legal all over the US, and Wall Street speculators have wasted no time getting into the industry. Foreign products are certainly here, and they are certainly cheaper than American-grown CBD, but consumers are also becoming savvier about recognizing quality.

In 2019, the CBD oil industry was valued at $1 billion. By 2025, market watchers expect it to explode to as high as $22 billion. But that’s got skeptics nervous. Is CBD just another bubble?

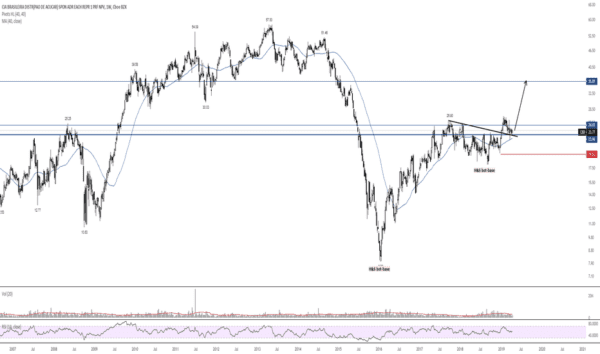

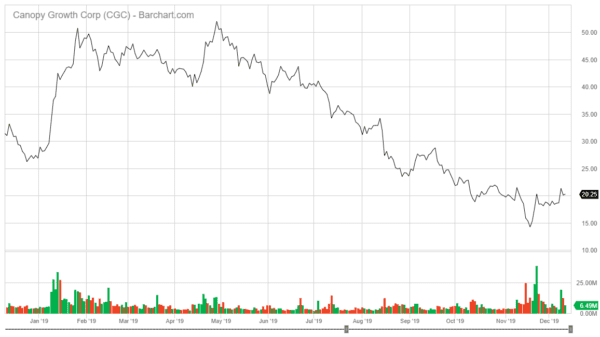

At the end of 2019, the stock position of the CBD industry is already down from a high in March, and even with a general trending up for the last few years, investors need to be realistic. Those coming at the industry from a bearish position have some very real concerns that need to be considered. At the same time, the pie-eyed bullish enthusiasm of those who think the market is only going up and up needs to be tempered with some common sense.

At Business Pundit, we want to be optimistic and realistic, so let’s take some time with the common complaints of the CBD bear marketers, and get some perspective on the complexity of the whole CBD market.

The Bear Position: As soon as marijuana is legal nationally, CBD will be dead in the water

Millennials and Zoomers may mock CBD as “Diet Weed” (as in the popular Lisa Simpson meme), but they’re missing one thing: a lot of people want diet weed. It shouldn’t be surprising; after all, taken together, Diet Coke and Coke Zero sell more than regular Coke.

The line of thinking behind this myth assumes that consumers are only buying CBD because they can’t buy THC – in other words, that THC (and its psychoactive effects) is the only reason for wanting to buy hemp. In that formulation, CBD is just a stop-gap, or even (gasp) a gateway product for the US market (and now we’re in a 1980s DARE PSA).

But the truth is that many consumers are more interested in the medicinal benefits of CBD than in the recreational benefits of THC. That demographic includes senior citizens and parents looking for products for their children. Half of American seniors reported trying CBD products, according to a 2019 Gallup poll, and senior women account for more than a fifth of CBD buyers overall. Baby Boomers might have made a culture of cannabis back in the day, but today, they’re far more interested in non-psychoactive CBD to control their joint pain.

In fact, if and when THC becomes legal nationally, it will be a serious boon to the CBD industry. The full legalization of THC would allow CBD companies to make a more effective product, and to expand their offerings. Right now, the market is tightly controlled; CBD products can contain no more than 0.3% THC, which is difficult to maintain. All hemp varieties want to generate THC, and keeping it that low causes significant problems for farmers and refineries.

But that artificial, legislatively-crafted distinction is also keeping medicinal CBD from being fully effective. There is scientific evidence suggesting that the medicinal uses of CBD – primarily anti-inflammation, seizure relief, and anti-anxiety – are compounded with the addition of THC. Just a little THC is enough – not in a high dose not enough for intoxication or psychoactive effects, but enough for the cannabinoids to interact the way they are supposed to interact naturally.

What that means for entrepreneurs and investors is that there’s still very good reason to bank on CBD, even while keeping their options open for the full legalization of marijuana. CBD has a far wider market share than THC ever could, for one obvious reason. While THC would most likely be focused on recreational products like vapes, edibles, and (obviously) smoking, CBD goes everywhere – beauty products, pain and inflammation relievers, sports and fitness products, and even pet products. No one is giving Fido marijuana, but many pet owners are turning to CBD pet products to help their pets with arthritis, intestinal issues, and anxiety.

Ultimately, the full, national legalization of marijuana will happen alongside the growth of the CBD industry, not replace it. So invest in CBD, be ready to invest in marijuana, and reap the benefits of both.

The Bear Position: Regulation will choke all of the profit out the industry

Many would-be CBD investors are scared off because of the shaky legal ground surrounding industrial hemp and marijuana, while entrepreneurs in the field are stymied by the many regulatory hurdles involved in getting a CBD business started. It’s the classic big-business complaint – “How can I make money with the federal regulators breathing down my neck!” – but with a product that has only now made the jump from controlled substance to legit investment, the reality is more complicated.

One of the biggest issues in the CBD industry, in fact, is the relative lack of regulation and standardization. The truth is, there’s only one really set-in-stone regulation: CBD products sold in the US must have no more than 0.3% THC content (unless it’s being sold in a state where marijuana is fully legalized). But otherwise, CBD is still in a gray area when it comes to regulation. The FDA has approved only one medication containing CBD as the active ingredient, and it is only prescribed for a very narrow use (treating two extremely rare forms of epilepsy). Otherwise, CBD resides in that shadowy realm shared by dietary supplements and homeopathic cures – leading consumers to feel less than confident.

The positive medicinal effects of CBD on certain issues like epilepsy, inflammation, and anxiety have been demonstrated by a strong base of scientific research. However, a lot is still not known, such as the ideal dosage of CBD for treating these problems, and without approved experimentation, these questions won’t be answered.

For entrepreneurs and investors, regulation is a double-edged sword. FDA approval as a drug would allow companies to back up their medical claims. It would open up the potential for further scientific testing and confirmation of CBD’s medical potential. But it might also end up limiting consumers’ access to CBD products if they were to end up behind the counter instead of over. And of course, FDA approval means greater scrutiny, which many CBD companies don’t want.

The fact of the matter is, with a product like CBD, a lack of regulation only helps people who want to get away with something – not consumers, and not legitimate entrepreneurs and businesspeople. As the market currently stands, when a consumer purchases a CBD product, it’s impossible for them to really know what they’re getting. They are at the mercy of the company to tell them the truth about their sourcing, about their testing, and about their actual CBD content.

Without anyone to answer to, the CBD industry has created an opening for many cut-rate companies peddling products that don’t live up to their claims. Consumers pay top dollar for products that turn out to be weak and ineffective. As the FDA has discovered in testing, many products do not contain as much CBD as they claim; some products contain next to none. Very few actually contain enough CBD to have the effects they claim, even if they are honest about their contents (as a skeptical Slate writer learned in a recent article). More alarmingly, tests of some CBD products have found dangerous contaminants, including pesticide residue and heavy metals.

For the time being, the market is working somewhat as it should; good companies are transparent about their products and are rewarded for their transparency. The internet gives consumers a way to get the word out about deceptive or shady companies through the many CBD forums and blogs. But at the moment, it’s hard to sort out what products are good, and without any centralized data, consumers are wary. That rightly makes many investors wary.

In addition to being essentially unregulated, the CBD market is also quite a way out from being truly standardized. There are no clearly established best practices when it comes to issues like labeling, marketing, or pricing, as consumers see when they set out to do their research. CBD oil prices are all over the place. Of course there’s no standardization; the market hasn’t existed long enough to establish a settled price. In the current boom, there are so many CBD brands (more than 400 at the beginning of 2019) that no consumer can be truly informed.

We’ve also seen that, in the current unregulated free-for-all, the market is saturated in cheap foreign products of dubious quality. While the American wellness industry loves its organically-grown, full-spectrum, artisanal CBD products, those are by no means the market standard. Most CBD products sold in drug stores and gas stations are made from mysteriously-sourced hemp processed and manufactured under who-knows-what conditions.

When the chips are down, the CBD boom is like any other boom. The fly-by-nights will pop up, make whatever money they can, and disappear. Successful companies will buy out their competitors and consolidate the market. The market will standardize, regulate, and stabilize. It may stabilize at a level lower than the current high, but more likely, we not have yet seen Peak CBD.

Many commentators worry that, before all that happens, sub-par products will cause consumers to distrust the whole industry, and certainly some people will give up after a bad experience. But CBD has an edge that obvious fads don’t (we’re looking at you, activated charcoal). Hemp is one of the oldest human-cultivated crops, and one of the most adaptable. Squash it in one place, it will pop up in another – which is also true of the hardy plant itself. Betting against hemp is like betting against bread.

To put it more bluntly, the key to keeping the CBD industry on the right trajectory is standardization and regulation that can assure customers that their CBD products have CBD in them, in dosage that will work.

The Bear Position: American hemp cultivation is still years away from becoming profitable, and will never compete with cheap hemp from China and India

So ultimately, despite the entrepreneur’s natural distrust of government regulation, more regulation and standardization will ultimately be good for the industry. However, if you’re considering investing in hemp cultivation (as a farmer or investor), there is one way in which current regulation is hampering the CBD industry – the official cap of 0.3% THC for all CBD products. In fact, it’s been the single largest hassle for farmers who want to experiment with growing industrial hemp.

The problem for farmers is that hemp naturally produces THC, and even strains that are hybridized for high CBD and low THC still produce THC. Plus, plants tend to produce more THC under stress, so plants that experience overly dry conditions, overly wet conditions, insect infestations, mold, and all of the other factors that cause stress will cause farmers even more stress by coming back from lab tests “hot” (containing too much THC). In states where hemp is legal, but not THC, that means an entire crop gets destroyed by the authorities.

It’s important to acknowledge that the 0.3% cap on THC is entirely arbitrary. It’s not based on any “safe dosage” (there is, as far as is known, no unsafe dosage of THC) or on any other scientific standard. In fact, no scientific trials have definitively shown whether that amount of THC will show up in a drug test. The only difference between industrial hemp and marijuana is this arbitrary distinction – the “two” plants are no more genetically different than a tabby cat and a calico.

However, this regulation – and the extremely decisive way it is enforced in prohibition states – has discouraged farmers from taking up the newly legal crop. Even though the profit margin for farmers is as much as three times as high as conventional crops like soybeans and corn, the risk of raising an entire field of hemp, only to see it plowed under or harvested and burned for being a tenth of a percent over the limit, is more than many farmers are willing to take.

CBD hemp cultivation is also an extremely labor-intensive proposition, especially because, unlike other more common produce, it’s not entirely mechanized yet. The machines that make large-scale factory farming possible don’t exist for hemp. Planting, pest control, harvesting, processing – on almost all the hemp farms in America, those crucial tasks still have to be done solely with human labor, because there are not planters or combine harvesters for hemp. Because farming hasn’t been done on a large scale, experts aren’t even sure what fertilizers work best for industrial hemp, and the EPA doesn’t yet know what pesticides are safe for use on hemp.

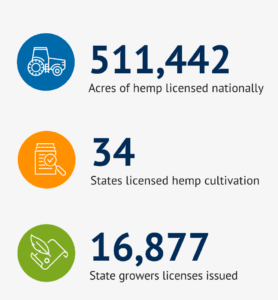

Of course, 2019 was the first year when farmers all over the US had the opportunity to put in a full year of hemp cultivation. Up until then, most states were only allowed research farms approved by the state (under rules set in the 2014 Farm Bill). That means that, for around two-thirds of the nation, industrial hemp cultivation is a matter of trial and error – and in farming, that usually means a lot of error. Hemp grows differently in each region, faces different threats in each region, and has different needs in each region.

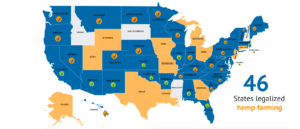

Now that industrial hemp has been cleared and legalized all over the US, a lot of the risks associated with cultivation will be ironed out. That means that while these early years may be a loss for farmers and investors, these early losses will pay off big for those who can stick it out. Legalization means that hemp farmers will be able to get crop insurance to leverage against bad yields. They’ll be able to get loans to invest in new machinery as it comes available. And with demand only going up, the machines will be designed, built, and brought to market as soon as capitalistically possible.

It’s fair to expect to see these improvements over the next 1-3 years, so that relatively soon hemp farming will grow out of its awkward early years into commercial maturity. But in the meantime, American investors are watching foreign imports very closely. Right now, the majority of hemp products are made from hemp imported from China, Canada, and other countries – for obvious reasons. Even products manufactured in the US usually come from a foreign source. In fact, many farmers source their seeds and seedlings for planting from Canada.

Hemp importation is the most obvious direction for American investors who want to see a return right away, especially as American hemp cultivation seems to be risky. Chinese and Indian hemp is much cheaper than American-grown hemp. But with ongoing trade wars and a growing America-first sentiment, it would not be surprising to see costs on imports go up. If that proves to be the case, investors with an eye on long-term gains might be more inclined to help the American hemp market develop.

So When is the Bust Coming?

If you’re hoping to get in on the ground floor with CBD, we’ve got bad news – the elevator left a long time ago. But if you’re anxiously waiting to cash out your CBD stocks before the big crash, keep waiting. This is not the dot-com bubble crash of the turn of the century; it’s a young industry finding its footing and growing up. Mistakes will be made, there will be ups and downs, but we don’t see imminent disaster.

Will the CBD oil industry stay on its high-flying trajectory, or is a big bust coming? It’s a false dichotomy, really – every boom busts at some point. There is no such thing as an endless boom. The real question is how the CBD industry will evolve, and how smart investors and entrepreneurs will adapt to whatever it becomes.