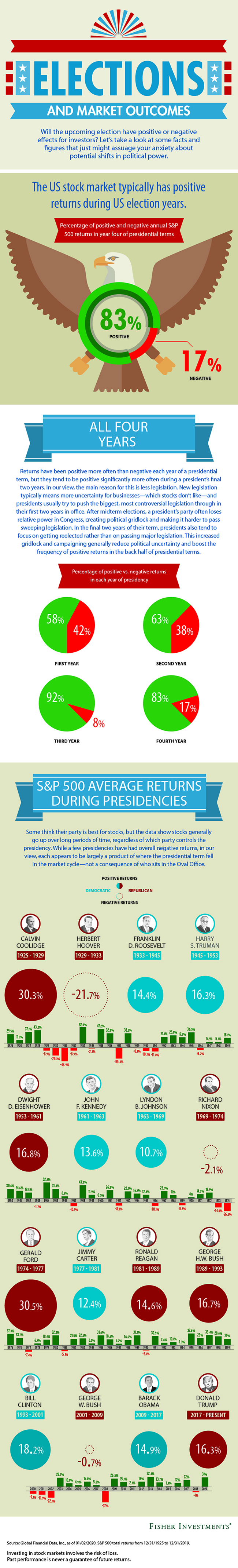

Elections and Market Outcomes – An infographic by the team at Fisher Investments

Investors may feel anxiety over the upcoming election and what it could mean for their investments. Elections can have a positive or negative effect on the stock markets. In the US, the markets typically do well during election years, but that’s not a given, especially given the rough ride of coronavirus.

The S&P 500 has seen positive returns of 83% in year four of presidential terms.

Less Uncertainty in Final Two Years of a Presidential Term

During the first two years of a presidential term, the president will typically attempt to get the biggest and most controversial legislation passed.

In the last two years of a presidential term, there is usually less legislation and therefore less uncertainty for businesses. Uncertainty can cause stock market losses, as we’ve already seen during the COVID-19 pandemic.

After midterm elections, the president’s political party usually loses some congressional seats making it more difficult to pass legislation and things on Capital Hill grind to a halt. With legislation stuck in a gridlock, a first-term president will usually spend the last two years of presidency focusing on reelection efforts.

Which Party is Best for the Stock Markets?

Republicans and Democrats would each like to take credit for positive returns in the markets, but stocks usually rise over long time periods, regardless of which party holds the presidential office. When overall returns are negative, it usually has little to do with the sitting president, but can be a product of where the presidential term fell in the market cycle.

Prior to the coronavirus pandemic, the S&P 500 had a 16.3% increase under President Donald Trump. The S&P 500 gained 14.9% during the Obama presidency.