Online tools and investment software enable investors to track their investments’ potential, ideas, and records in more detail. They are most useful for intermediate to advanced investors. In this article, we’ll differentiate between online tools and investment software, explain the perks of each, give you a list of the best ones, and cover some additional ways that you can use online tools and investment software.

What’s the difference between online tools and investment software?

The main difference is the level of detail. Online tools refers to investment tools available online, often for free through your brokerage account. Basic online tools offer you:

-Live quotes

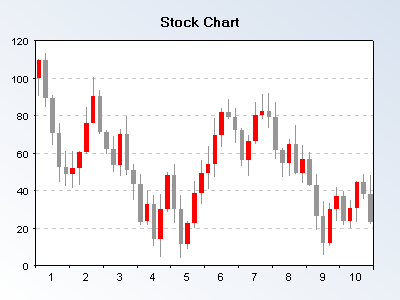

-Stock trend charts and historical price information

-Companies’ financial data

-Portfolio performance charts

-Charts illustrating your asset allocation

-The ability to allot how much money to give each trade and automatically stop losses

-Alerts

-Equity analysis

-Financial calculators

-Account balances

-Transaction history

-Stock selection tools

-General advice and help

Five Recommended Sites for Online Tools

Yahoo Finance: Excellent resource for ticker information and public documents.

MorningStar: Excellent site for mutual fund information, as well as for stock investing tools.

MarketWatch: Up-to-the-minute market news is this site’s strength. It is also an excellent resource for tracking indexes and IPOs.

Investing in Bonds: The resource for bond investors.

E-brokers also offer investing tools. These include ETrade, Vanguard (for customers), and the online services of Morgan Stanley (for customers).

Investment Software

Most investment software contains all the features of online tools, with a few added perks to help you organize, visualize, and stay disciplined. Among the more common features of investment software:

-It is designed to be easy to navigate, which could save you hours of research

-Visuals like charts and graphs are more extensive and/or more customizable, giving you an easy-to-process overview of your portfolio.

-Some investment software offers tools to help you see when a stock is oversold or overbought.

-Tools to help you project your investment’s success over a certain period of time

-Trading and risk management plan templates and checklists

-The ability to compare your strategy to that of prominent or successful investors

-Checklists and plans to help you make more rational decisions

-Analyze capital gains and losses so that users can tweak their portfolios to minimize taxes

-Automatically rebalances your portfolio

-Scans markets for new investment opportunities based on your criteria

-Offers goal-setting tools

Investment software usually requires an annual subscription or download fee, although you can also find freeware. Online tools are generally free.

Why would you buy investment software?

To save time. When you have all of your resources in one customized place, you will ideally be able to save hours of online research and homemade spreadsheets. Investment software is especially useful for professionals, day traders, and active investors. Passive investors (those who buy and hold for more than 6 months) may find it to be a waste of money.

Most professional traders, on the other hand, need investment software to do their jobs. Not only does it save time, but it generates automatic reports for clients, tracks their portfolios and billing accounts, automatically rebalances portfolios, supports multiple currencies, tracks pooled funds, measures ROI, runs reports from multiple accounts, and more. The average investor will find these tools superfluous, but to professionals, they are indispensable.

Recommended Investment Software for Active Investors

Portfolio Manager: The perk with this investment software is simplicity. You can track each of your holdings on a single screen, allowing you to stay aware of your investments’ real-time prices, how long you’ve held them, dividends, and trends.

CharTTool: As its name suggests, this investment software’s strength lies in its charts. You can customize, follow, and print several stock charts on the same screen. Also contains a good list of technical indicators.

Recommended Investment Software for Day Traders

CQG: CQG tagets day traders with bigger accounts or money to invest in good software. Known for its quality analytics, customizable indicators, studies, and charts, CQG is a favorite high-end software.

Wealth-Lab Developer: This portfolio simulator helps you perfect your strategy, which is helpful in a game where accurate, fast decisions are of the essence.

QuoteTracker: A good option if you want to save your funds for investments, QuoteTracker is reliable and intuitive. Its attractive price tag makes it a good basic to add to your software suite.

Recommended Investment software for Professionals

Button Trader: This software’s hotkey system gives new meaning to instant trading. Low price and excellent support make it a solid investment.

TeleChart Gold: Although coders may find this software more intuitive than technical laypeople, its wide range of capabilities—especially in scanning—is a key attribute that many professional investors and day traders find extremely helpful, especially for EOD trading.

Wireless Online Tools and Investment Software

You can always use online investment tools on your mobile device. Some companies also offer mobile versions of investment software; other apps are designed exclusively for wireless use. They’re perfect when you’re on the go and need to check your finances frequently. Examples include Finance Genius for the Palm, the AquaSys Pocket Investor for Pocket PC, and StockWatch for the iPhone.

Conclusion: It pays to research online tools and investment software to find the best combination of products to suite your needs. Especially for investment software, one size fits many, but not all. Good luck, and happy investing!