No economic calamity before or since has matched the stock market crash of 1929 and the ensuing Great Depression. It would bedevil the world economy for well over a decade, only being fully vanquished along with the Nazis after World War II.

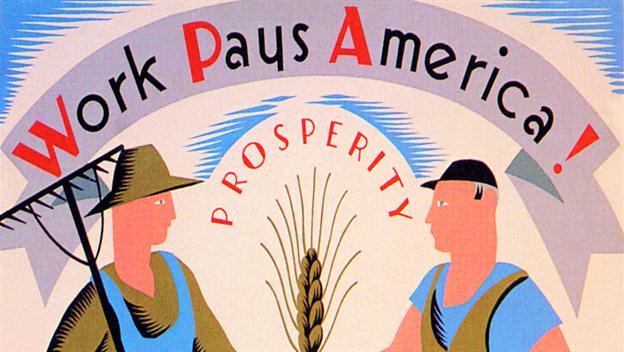

President Franklin D. Roosevelt would take a stridently activist approach to dealing with the Depression’s effects (including a near-25% unemployment rate when FDR took office). The New Deal touched everything from the home loan industry to construction projects like the Hoover Dam, job programs for writers and artists, and support for farmers. World War II, which began ten years after the stock market crash, would finally help spark a sustained recovery.

Several programs and agencies established by the New Deal still exist today, including the Federal Deposit Insurance Corporation (FDIC), Federal Housing Administration (FHA), Social Security, and the Securities and Exchange Commission (SEC).

Two particular policies of this period will resonate in later bailouts. Fannie Mae, which was established in 1938 to help Depression-era Americans purchase homes, will show up later on this list when, ironically, it needed its own bailout. And the Glass-Steagall Act of 1933 included provisions restricting banks from associating with securities firms. Those restrictions were lifted in the late 1990s and have been cited by some as a cause of the financial crisis of the late 2000s and the Great Recession.