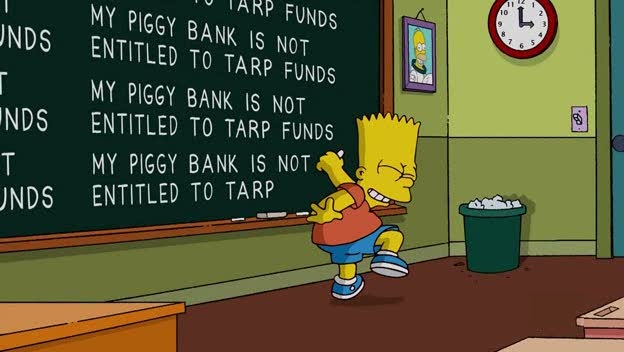

In the fall of 2008, the American financial system was on the brink of collapse. The House of Representatives first rejected a bill to bail out the struggling financial institutions; the idea of spending taxpayer dollars to help out reckless bankers proved, unsurprisingly, to be politically toxic. But despite that widespread disgust, the debate was eventually won by those warning that the big banks were just “too big to fail” and letting them do so would spark a market collapse and depression. After several days of debate, a revised version of the Emergency Economic Stabilization Act of 2008 did become law and spawned the Troubled Asset Relief Program, better known as TARP.

TARP earmarked $700 billion to buy the banks’ “troubled assets,” essentially securities backed by under water mortgages, but as of September 2012 the nonpartisan Congressional Budget Office reported that only $431 billion of that would actually end up being disbursed.