College endowments are big business, but did you know how much they have grown since the 90s? Endowments are the investments and donations by companies and individuals towards a college intended to help them grow and fund future investments. These are often ring-fenced for certain purposes by those who have made the donations, who can insist that the money is used to fund scholarships or to attract high-quality lecturers, etc.

According to University Business, over the last 30 years, the value of the 20 largest college endowments grew at an average annual rate of 8.5%, which is higher than the 6.6% rate of the Fortune 500. The total market value in 2018 was $624.3 billion across 810 colleges, but there’s inequality at play with the top 20 colleges sharing 48.3% of that amount and the other 790 having to spread the rest between them.

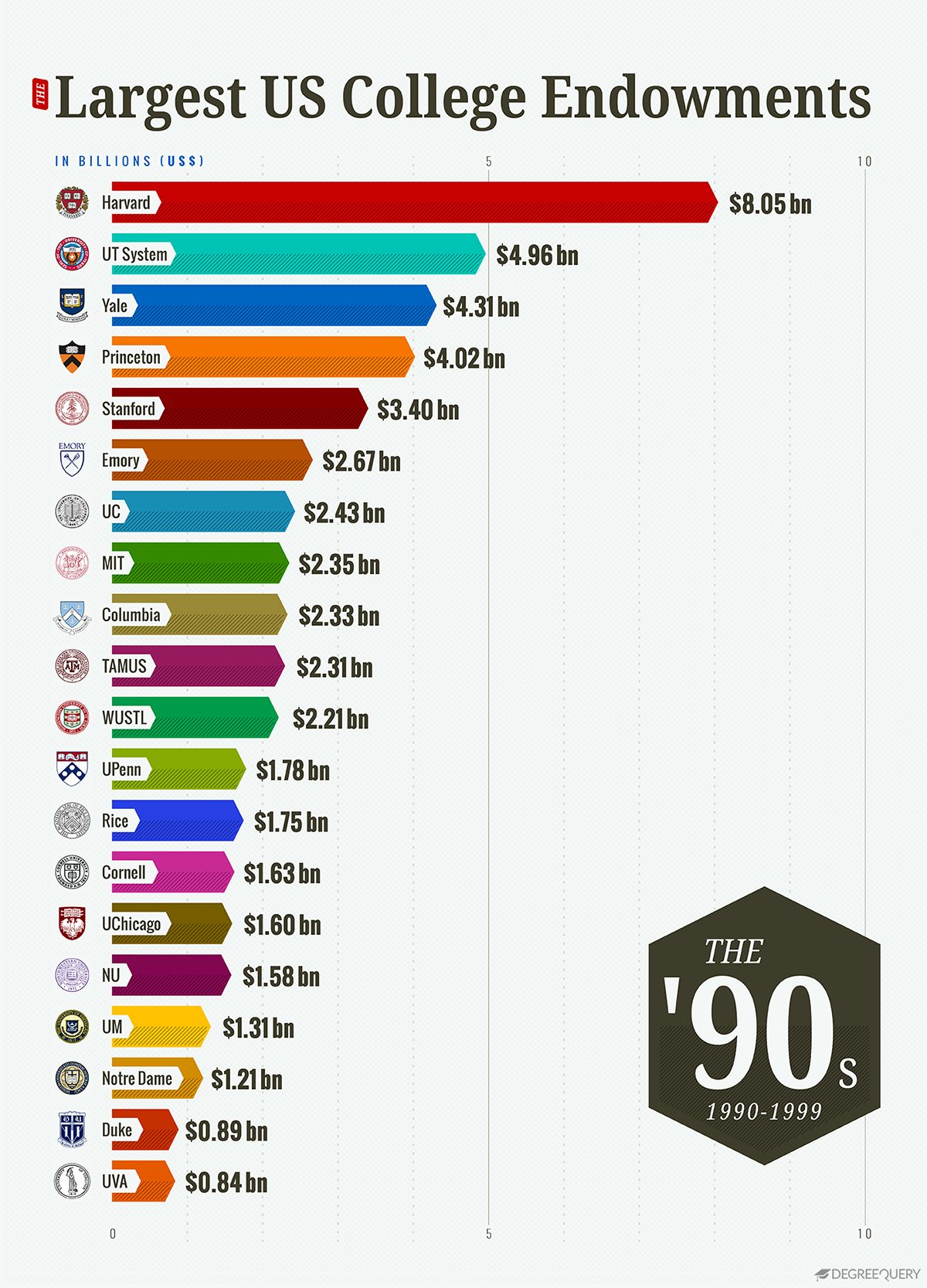

This chart by DegreeQuery shows that the 1990s were when this rapid growth in endowments really began, with a remarkable average annual growth of 12.5%. The leading college for endowment value was Harvard with $8.05bn putting it well ahead of UT System in second place at $4.96bn. The gulf between the haves and have-nots was already clear, even within the top 20 colleges, with Duke and UVA both at less than $1bn, and that gap has only grown since.

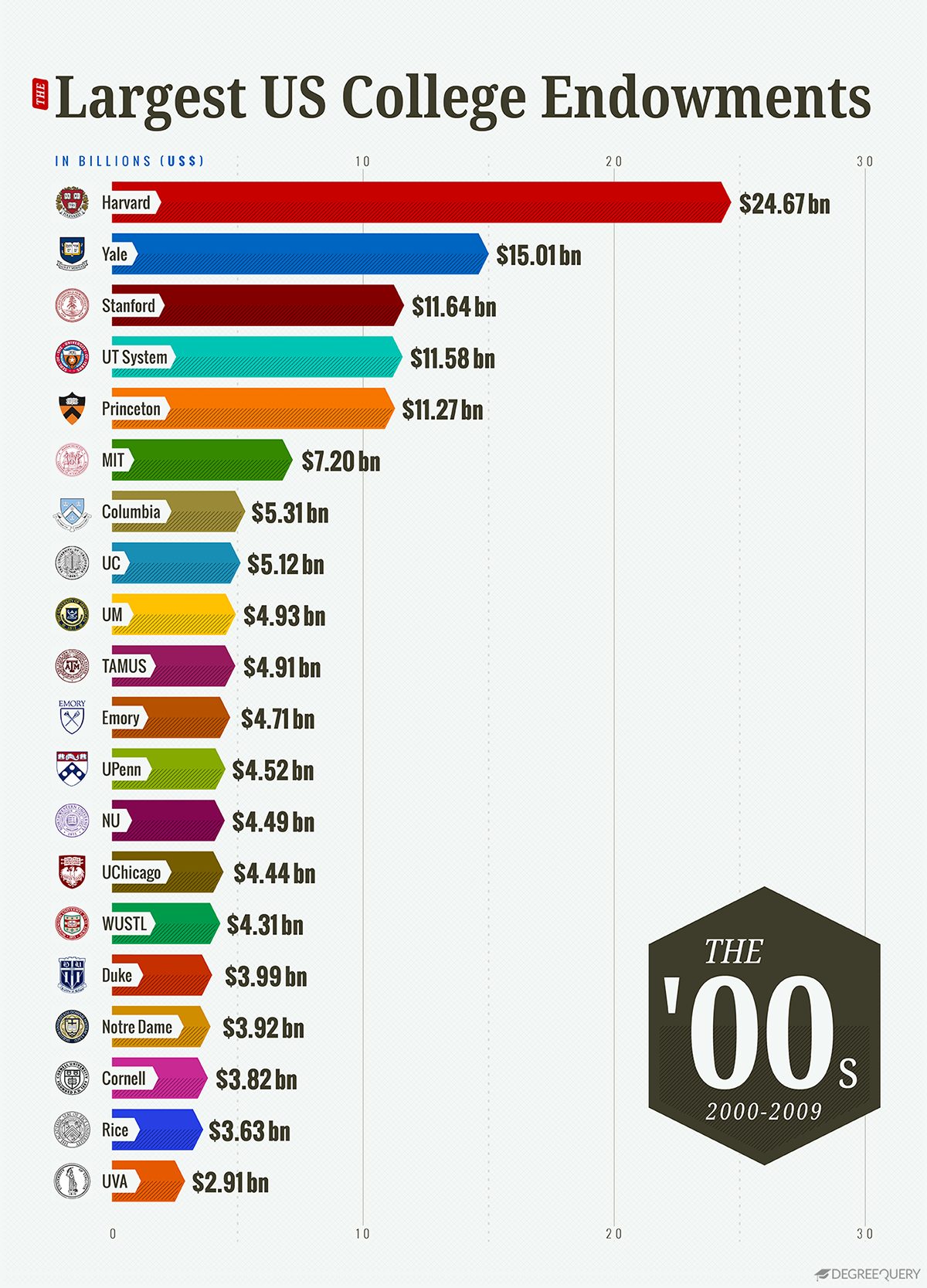

By the end of the 00s, UVA’s endowment value had risen slightly to $2.91bn, which would have been enough for a sixth-place finish in the 90s, but keeps them in 20th a decade later. At the other end of the scale, Harvard’s endowments had risen to $24.67bn, a huge financial advantage over its competitors, with second-placed Yale only getting $15.01bn.

However, Yale’s endowment value was significantly hit in the late 00s by the economic downturn after the 2008 financial crisis. While the total value of the 20 largest endowments went down by 3.4%, Yale lost 28.6% of its market value, while Harvard, Duke, and Stanford also lost because of the recession. As a result of these losses, the average annual growth for this decade was just 3.5%.

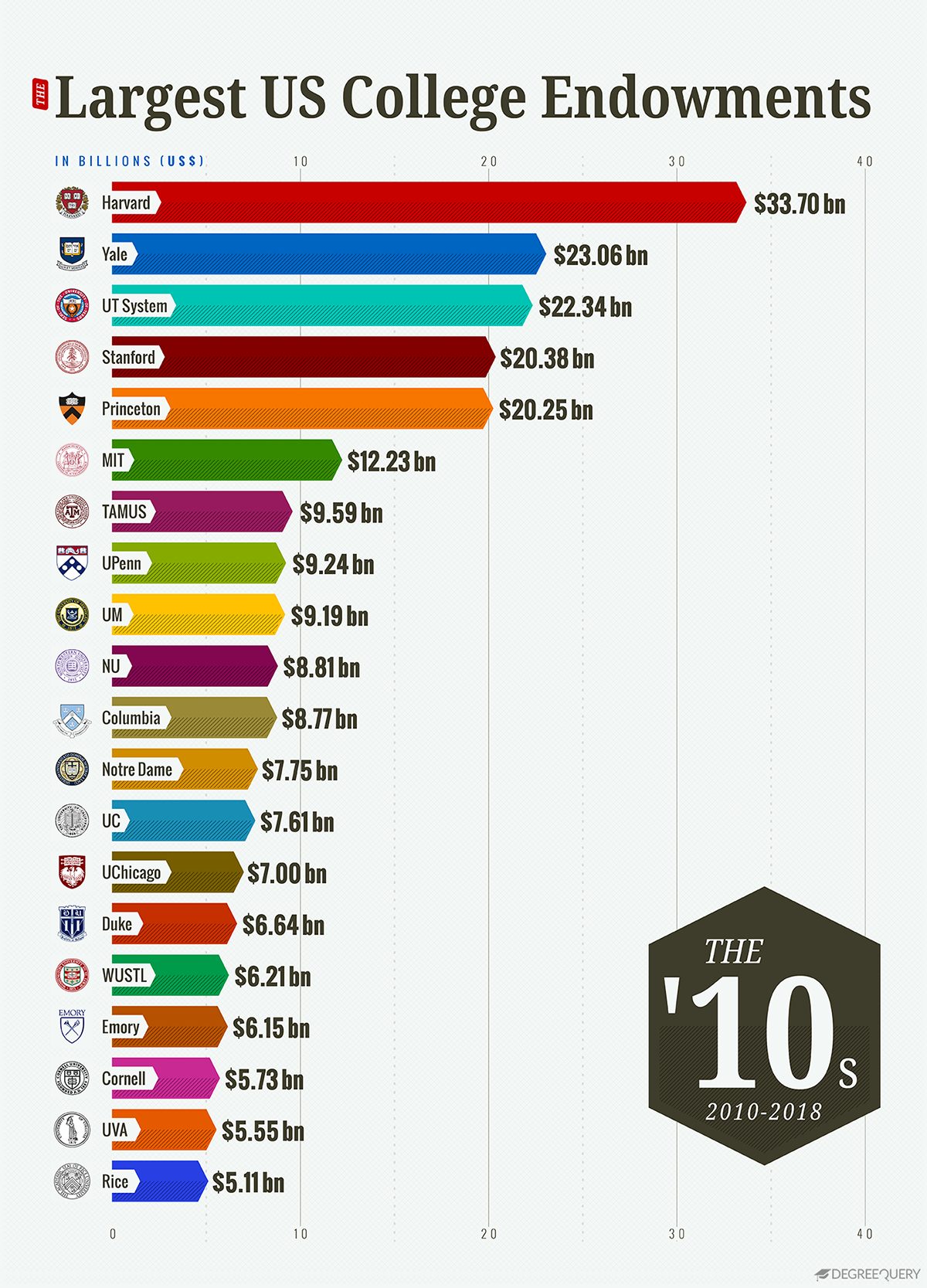

In the 10s, the economy began to recover, and this was reflected by the average annual growth rate for the top 20 college endowments going up to 7.6%, which may still have been way behind the rate from the 90s, but still represents an impressive level of growth. At Harvard, the value of its endowments had risen to $33.70bn, which clearly wasn’t seen as enough as 50% of its endowment management staff were laid off in 2017.

Of course, even relative failure for Harvard means that it remains clear at the top of the list, with the rest of the top colleges still playing catch-up. College endowments have changed a lot over the last 30 years and play a huge role in how our young adults receive their all-important education. What changes and growth will this new decade see for these top 20 college endowments?