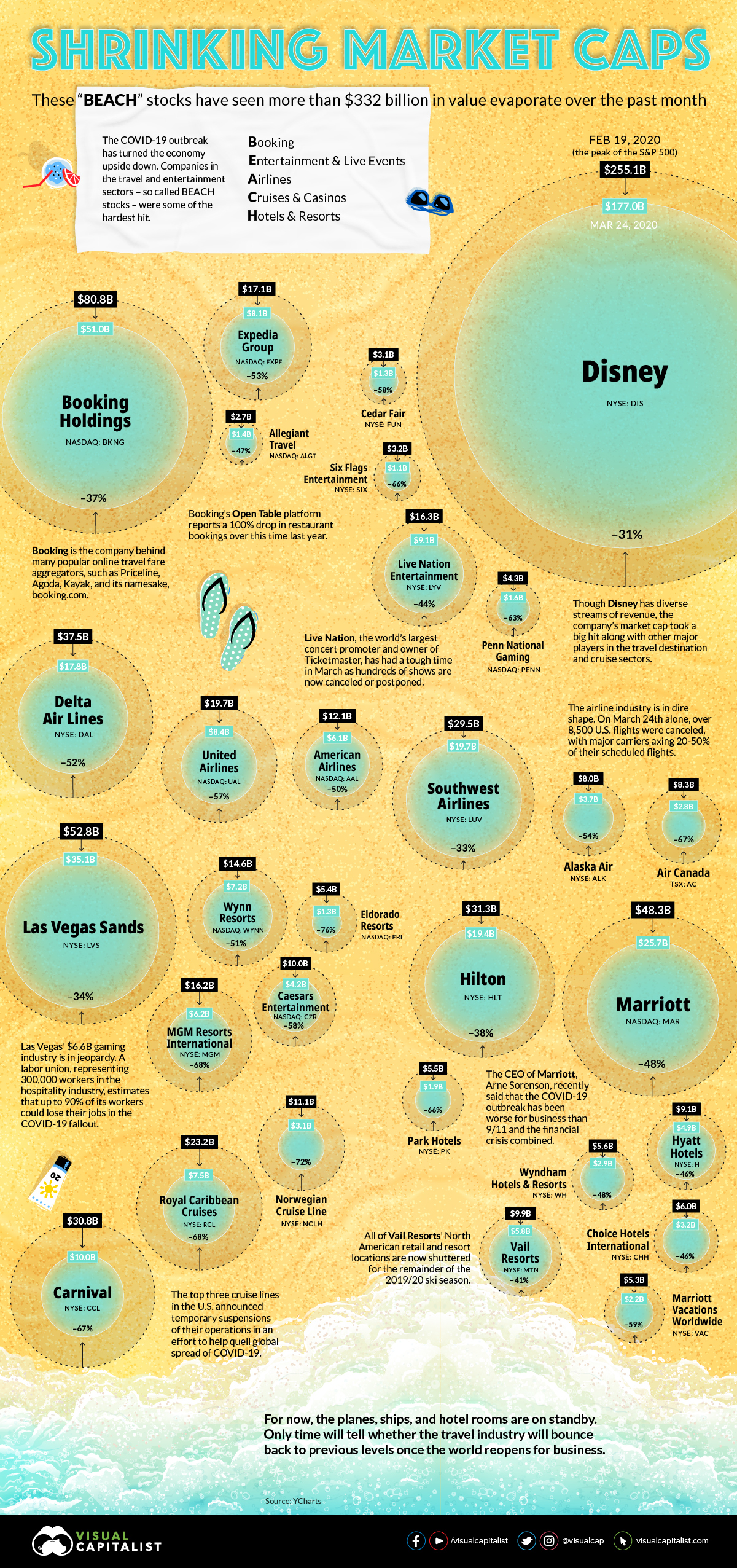

The COVID-19 pandemic continues to ravage the stock market, with the first quarter closing with some of the steepest downturns in history. Some industries have been hit even harder than most and will likely continue to hemorrhage cash for the foreseeable future.

“BEACH” Stocks:

- Booking

- Entertainment and Live Events

- Airlines

- Cruises and Casinos

- Hotels and Resorts

Companies in the travel and entertainment sectors (the BEACH stocks) have lost a staggering $332 billion in value from February 19, 2020 (the peak of the S&P 500) to March 24, 2020.

These companies, for example, have sustained catastrophic losses in value due to coronavirus:

Disney -31%

NYSE: DIS

$255.1 Billion to $177 Billion

Booking Holdings -37%

NASDAQ: BKNG

$80.8 Billion to $51 Billion

Expedia Group -53%

NASDAQ: EXPE

$17.1 Billion to $8.1 Billion

Allegiant Travel -47%

NASDAQ: ALGT

$2.7 Billion to $1.4 Billion

Cedar Fair -58%

NYSE: FUN

$3.1 Billion to $1.3 Billion

Six Flags Entertainment -66%

NYSE: SIX

$3.2 Billion to $1.3 Billion

Live Nation Entertainment -44%

NYSE: LYV

$16.3 Billion to $9.1 Billion

Penn National Gaming – 63%

NASDAQ: PENN

$4.3 Billion to $1.6 Billion

Delta Airlines -52%

NYSE: DAL

$37.5 Billion to $17.8 Billion

United Airlines -57%

NASDAQ: UAL

$19.7 Billion to $8.4 Billion

American Airlines -50%

NASDAQ: AAL

$12.1 Billion to $6.1 Billion

Southwest Airlines -33%

NYSE: LUV

$29.5 Billion to $19.7 Billion

Alaska Air -54%

NYSE: ALK

$8 Billion to $3.7 Billion

Air Canada -67%

TSX: AC

$8.3 Billion to $2.8 Billion

Las Vegas Sands -34%

NYSE: LVS

$52.8 Billion to $35.1 Billion

Wynn Resorts -51%

NASDAQ: WYNN

$14.6 Billion to $7.2 Billion

Eldorado Resorts -76%

NASDAQ: ERI

$5.4 Billion to $1.3 Billion

Caesars Entertainment – 58%

NASDAQ: CZR

$10 Billion to $4.28 Billion

Hilton – 38%

NYSE: HLT

$31.3 Billion to $19.4 Billion

Marriott -48%

NASDAQ: MAR

$48.3 Billion to $25.7 Billion

MGM Resorts International -68%

NYSE: MGM

$16.2 Billion to $6.2 Billion

Park Hotels -66%

NYSE: PK

$5.5 Billion to $1.9 Billion

Wyndham Hotels & Resorts -48%

NYSE: WH

$5.6 Billion to $2.9 Billion

Vail Resorts -41%

NYSE: MTN

$9.9 Billion to $5.8 Billion

Choice Hotels International -46%

NYSE: CHH

$6 Billion to $3.2 Billion

Marriott Vacations Worldwide -59%

NYSE: VAC

$5.3 Billion to $2.2 Billion

Hyatt Hotels -46%

NYSE: H

$9.1 Billion to $4.9 Billion

Carnival -67%

NYSE: CCL

$30.8 Billion to $10 Billion

Royal Caribbean Cruises -68%

NYSE: RCL

$23.2 Billion to $7.5 Billion

Norwegian Cruise Line -72%

NYSE: NCHL

$11.1 Billion to $3.1 Billion

While the airlines specifically will receive aid from the CARES Act, a large chunk of the $2 trillion relief aid will go to big businesses. The injection of cash will certainly help many companies and their workers, but falls far short of recovery. It’s not known how long it could take for the BEACH stocks to recover — or if they will be able to at all.