Reputation is everything. Especially in the higher echelons of business, where the reputation of a CEO can determine a company’s fate.

Some CEOs benefit their companies by cultivating positive reputations. They may end up as popular heroes, like Patagonia’s Yvon Chouinard, or Business Hall of Famers (and future governors?) like eBay’s Meg Whitman.

Some CEOs, however, are more likely to leave you with arched eyebrows and “WTF?” on your lips. We focused on these specimens to bring you 25 of the world’s most controversial CEOs. While the extents of their perpetrations vary, the common thread is this: When it comes to generating controversy, these guys have ended up on top.

25. Elon Musk

It’s difficult getting to the top of the food chain without pissing people off. Although all the controversies that surround Paypal cofounder and Tesla Motors CEO Elon Musk manage to work themselves out, one has to wonder why he’s at the center of so many.

Some, like calling a reporter a douchebag or saying the Toyota Prius isn’t a real hybrid—then teaming up with Toyota in true frenemy fashion—are obvious.

Another time, in an attempt to catch employees who were leaking confidential Tesla information to the media, Musk sent Tesla employees a slightly altered version of an email about stopping company leaks. He wanted to see who would leak it to the media. But Musk didn’t tell any other Tesla executives that he did this. So when employees informed execs about it, everyone knew about the setup. Whoops.

Oh, and Musk is currently out of cash. But don’t think that’s going to stop him.

24. Carly Fiorina

Carly Fiorina promised the sun and moon when she came to HP in 1999. She touted innovation, better profits and reinvestment into R&D and IT. She ended up failing to deliver on all three.

Fiorina’s HP spent $19 billion to acquire Compaq, but the only profits the company saw since the 2002 acquisition were those made from selling replacement ink jet cartridges. The company’s stock went from a peak of nearly $70 a share to less than $20 with Fiorina at the helm. Whatever the Compaq acquisition meant for HP’s long-term future, during Fiorina’s reign, the results just weren’t there.

In 2003, however, change came to HP. Following the RIFs of over 18,000 staff members, Fiorina froze salaries of the remaining employees. To further endear herself to the company, she increased her bonus that year and bought herself a private jet. HP’s Board of Directors finally gave Fiorina $21 million and told her to go away.

23. Donald Trump

Image: Matthew Haggerty/Flickr

Self-made millionaires who earned their fortunes doing an honest day’s work propped up the corporate history of America. Today, however, it seems that professional media hypers have taken their place.

Donald Trump, ole comb over himself, can add President of the Media Hype Millionaires Club to his resume. Here’s what makes Trump the top pick among the many CEOs who could easily lead such an esteemed group of jokers:

• Trump has been through more near-misses with bankruptcy than any other billionaire in history

• His wives are usually the last to know he’s divorced them and remarried a younger version

• A man with his track record has no business judging Miss America

What we wouldn’t pay to hear someone tell him, “You’re Fired!”

22. Phil Mulacek

Nepotism is nothing new in Corporate America. But InterOil Corp’s CEO Phil Mulacek took it to a new level.

In 2002, Mulacek contracted “unspecified ‘services’” to Direct Employment Services Corp., whose officers couldn’t be identified and whose services were nebulous at best. Said officers also happened to be relatives and/or employees of InterOil company. Does it sound convoluted? Well, the SEC’s interest was piqued when a contract was awarded to the tune of $1.8 million to a seemingly fictitious company.

When the SEC came knocking on Mulacek’s corner office, he threw the cherry on top of the situation by pulling an Oliver North. According to court document transcripts of the recent SEC hearing, whose purpose was to “connect the dots,” InterOil’s connection with two companies came up.

Despite being introduced to the fact that both Biltrust, Ltd. and Eurostar Fund, Ltd., list their addresses as the same as InterOil’s, Mulacek denied knowing them. Ollie North would be proud.

21. Michael O’Leary

Image: Political Animals

If there’s one thing Ryanair’s chief executive, Michael O’Leary, seems to love, it’s the feel of his mouth as he utters obscenities. Perhaps he finds it amusing to use the F-word a reported 14 times when speaking at a news conference. At another press conference, one he set up to discuss Ryanair’s plans to offer intercontinental service, he joked about its first-class service by saying it could feature, “Free beds and a blowjob.” Classy!

Perhaps, as one of Ireland’s wealthiest citizens, O’Leary doesn’t give a &*%$ about how he sounds in public.

Amgen CEO Kevin Sharer had to have scientists teach him about science after he took over the leadership role at the company. Maybe he should have had them teach him a little bit about running a company, too. Between 2000-2008, Amgen stock dropped 4% on average, while Sharer raked in an average annual salary of $12.3 million, according to Pharmalot.

In the midst FDA warnings, an SEC probe, and layoffs, the one thing that didn’t change was Sharer’s kingly salary. In 2008, investors grew so embittered with Sharer that they circulated a petition to force him to resign at the annual shareholder meeting.

19. Marc Cuban

Image: duncandavidson/Flickr

He’s the John McEnroe of basketball–shoots off his mouth, gets fined and then has to eat crow the next day.

When Dallas Mavericks team owner Marc Cuban isn’t directing his hostility toward members of the opposing team, he’s slinging mud at the referees and the league itself. In fact, his fines to date have swelled well above $1.7 million, which are mere peanuts for a man whose net worth exceeds $2.3 billion.

Part of Cuban’s “pep talk” to the NBA’s manager of officials, Ed T. Rush, was the Rush “couldn’t even manage a Dairy Queen.” You’ll be pleased to know that not only did Cuban apologize to Dairy Queen, he went so far as to work at his local one in Dallas for a day. Rumor has it that the ice cream chain sold more Blizzards™ that day than any other in history!

18. John Mackey

Image: Joe Marinaro/Flickr

Whole Foods CEO John Macket is a rare animal. That is, he’s a vegan libertarian who opposes both health care reform and the science behind climate change.

He’s also outspoken to a fault. Last year, he led his crunchy liberal consumer base to boycott Whole Foods by writing a Wall Street Journal op-ed opposing health care reform. Before that, he masqueraded as someone else on an Internet forum, where he would extol both Whole Foods and the “handsome” John Mackey.

While Mackey remains an unpredictable corporate character, one thing remains solid: he’ll probably generate another controversy. He can’t help it.

17. Gary Beer

What happens when you take an institution running on government funding, endowments, retail shop profits and donations, whose name is known globally for providing 19 museums, several research centers worldwide and two magazines, and hire a corporate “muckity muck” to run things?

You get the following:

• Irregular accounting

• Padded expense reports

• A brand new executive committee whose individual annual bonuses exceed their predecessors’ salaries three years running

• And an executive assistant who’s been promoted to a Vice President, earning $140,000 with no qualifications to warrant such a jump

These are just some of the radical changes the 160-year-old Smithsonian Institution underwent after it brought in Gary M. Beer as its CEO in 1999.

To the Institute’s credit, it saw sharp declines in attendance and profits and saw Beer, formerly of the Sundance Group, as the savior they needed. Indeed, profits were up one of the 7 years he was running the show, but they were eaten up when the E.C. took home $2.7 in bonuses.

On a bright note, after a thorough audit of expenses submitted by Beer, the Institution’s Inspector General ordered he repay $30,000.

16. Mike Jeffries

All companies want to make a profit, right? It’s the underlying principal of capitalism. Do companies push the envelope at times? Absolutely.

But come on, little girls in thongs? Abercrombie & Fitch’s CEO Mike Jeffries thinks there is nothing wrong with putting thongs on girls ages 10 through 16. While 16 might be borderline, there’s nothing borderline about a ten-year old wearing a thong.

And what’s up with marketing only to cool, good looking kids? That’s just his marketing practice. Explain how a CEO gets paid $4 million on top of his $36.3 million annual compensation for NOT using the corporate jet for unlimited personal use? Does this mean that it costs less to pay him $4 million than to maintain the jet?

Is this the message he wants to send to cool, good looking, thong-wearing kids?

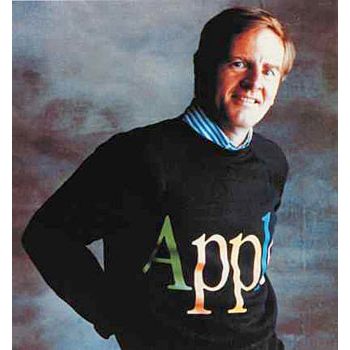

15. John Sculley

“Do you want to spend the rest of your life selling sugared water or do you want a chance to change the world?”

Back in 1982, Apple chairman Steve Jobs used these words to recruit John Sculley, then president of Pepsi-Cola. No one, least of all Jobs, realized those words would end up being the most costly of his career.

For Apple, 1983-93, or The Sculley Era, was remarkable for the sheer number of people Sculley pissed off. There was the brouhaha between Microsoft and Apple because Sculley wouldn’t change its interface to Windows based. A separate lawsuit filed by Apple for copyright infringement didn’t further endear him to Gates and company. Microsoft responded by threatening to discontinue making Office for Apple. Fearing a negative impact on Apple’s profit and stock, Sculley acquiesced.

Endless power struggles ensued between Sculley and Jobs, which finally resulted in Jobs being pushed out for the crime of being “too linear.”

The Sculley Era behind them, Jobs is back on the job.

14. Nusli Wadia

As the saying goes, “The apple doesn’t fall far from the tree.” A member of one of India’s oldest business families, Nusli Wadia learned his trade from masters of deceit.

Backstabbing their own relatives as they would their enemies, his grandparents, parents and godparents set an unbelievable example for the impressionable Wadia.

It seems only fitting that someone who inherited unrivaled entitlement, loyalty to no one, and the fighting ability of a cornered cat would, at the tender age of 15, use his mother, sisters and the labor union to thwart his own father’s efforts to sell the family business. Today, Nusli Wadia is the CEO of the Bombay Dyeing & Manufacturing Co. Ltd., and owns an awful lot of real estate in and around Mumbai.

The subject of several wire-tappings, Wadia has even been accused of being a Pakistani spy. Why wouldn’t he attempt to first use an Indian passport when he was a British national, then, upon gaining Indian citizenship, attempt the opposite? This man has chutzpah that even the president of India or the United States couldn’t touch.

13. Bob Nardelli

Starting out as an entry-level factory worker with General Electric in 1971, Bob Nardelli rose through the ranks. He eventually ran GE’s energy business, where he boosted the company’s revenue to $20 billion dollars. Despite his achievement, he came in 3rd in a 3-way tie to replace GE’s retiring CEO.

Like a free agent in the major leagues, Home Depot picked up Nardelli within minutes as its CEO. In exchange for his $37 million annual compensation, he promised to boost sales and the company’s stock.

Neither occurred. To add insult to injury, while Home Depot’s stock fell, rival store Lowe’s increased 173%. The Nardelli pulled a bizarre stunt at the last shareholders’ meeting he led. Nardelli both omitted the board of directors’ attendance and refused to answer questions. Home Depot ousted him over a salary dispute soon after.

Ducking into near-seclusion for ten months, Nardelli emerged at the helm of the private firm that owns Chrysler. But only 20 months later, Chrysler filed for bankruptcy protection.

Moral of the story: If Nardelli comes to you for a handout, watch out.

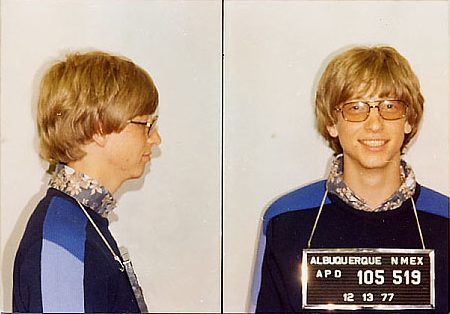

12. Bill Gates

While the world sees Bill Gates, former CEO of Microsoft, as a kind-hearted, demure philanthropist, there’s a flip side. Let’s just say you can’t be one of the richest men on earth without ruffling a lot of feathers.

Gates-era Microsoft is known for its embrace, extend and extinguish strategy, in which the company embraced open-source technology, added in-house features and capabilities to it, then tried to extinguish it with Microsoft products.

Microsoft used its monopoly power to threaten suppliers. For example, it threatened to buy chips from competitors if Intel expanded into the internet software market. Microsoft also threatened to “stop producing its Office software applications for the Mac if IE wasn’t given favor over Netscape’s Navigator browser on the Mac,” according to this ZDNet article. The list goes on. Let’s just say that Microsoft’s reputation as an evil monopolist had lots of evidence to back it up.

The controversy doesn’t end there. To work for Bill Gates, you have to have extremely thick skin. Numerous stories have surfaced about life under Bill Gates’s thumb. From loudly inviting a programmer who dared disagree with him to go join the Peace Corps, to expressing his anger at having to take another programmer’s work home and redoing it, because it was reportedly garbage and shoddy.

Maybe Gates is better off as Chief World Savior.

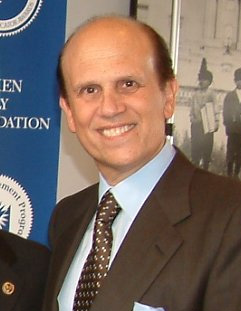

11. Michael Milken

Although Michael Milken graduated from same high school as Cindy Williams and Sally Field, it’s pretty clear they ran with separate crowds. Talented, wholesome and at times feisty might come to mind when describing the Golden Globe winner (Williams) and the two-time Oscar and three-time Emmy winner (Field), but no labels can compare to the ones given their classmate:

• Felon

• Junk Bond King

• Corrupt

• One of the few people indicted under the RICO statute

After suspecting corruption for ten years, the SEC tried in earnest to catch Milken in the act. They even sweetened a deal for insider trading scamster and Gordon Gekko inspiration Ivan Boesky to cooperate with them.

Meanwhile, Milken’s firm, Drexel Burnham Lambert, repeatedly denied any wrongdoing. Why would they say otherwise? Milken made them billions defrauding people out of their money.

Finally, in 1990, after the death of his attorney (the same one who represented many of the thugs involved in Watergate as well as known Mafia Crime bosses), Milken pleaded guilty to six counts of SEC violations, nothing compared to the 98 indictments handed down.

10. Jimmy Cayne

Let’s say you run a company. One of your divisions is failing. Practically overnight, your company sees a 10% decline in earnings. Things are getting bad enough that several banks are pressuring your company to increase the collateral made on loans you’ve borrowed from them. They’re asking for $3.2 billion, but they’ll accept an increase of $1.7 billion.

For most CEOs, this would be worrisome. It may even cause you to break a sweat, write a press release, hold a press conference, or rethink the strategy of the way your company is doing business.

If you’re Jimmy Cayne, CEO of Bear Sterns, it gives you motivation to hitch a ride on the company helicopter and shoot near perfect games of golf. In fact, the worse things got with Bear, the better his game became.

It gives new meaning to the expression, “When the going gets tough, the tough play golf!”

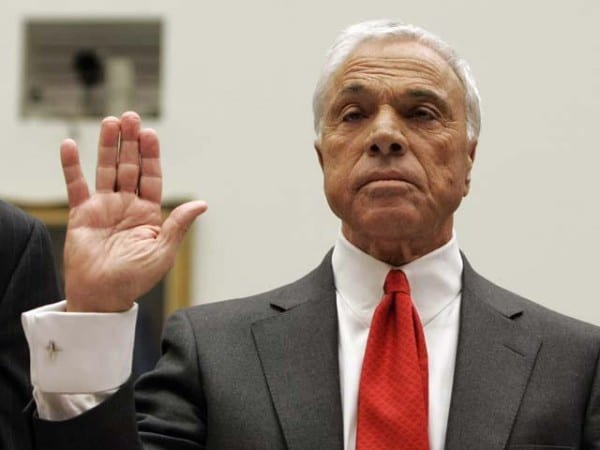

9. Angelo Mozilo

As we now painfully know, there was strange period between 2003 and 2007 when people could get an interest only-mortgage or adjustable rate mortgage (ARM) on stated income only, no money down, and with a low FICO credit score.

During the height of the ARM craze, people earning $50,000 annually bought homes for $500,000 with no money down, then took equity out of their homes (which didn’t exist because they put nothing down) to redo their backyards for $100,000.

Countrywide Financial led the brigade of easy loans. Angelo Mozillo, ol’ spray-on tan himself, was at Countrywide’s helm.

As ARM homeowners saw their monthly payments jump to $2540 overnight, most understandably began defaulting on their mortgage. But by then, Mozilo had already lined his pockets with millions—and gleaned valuable government contacts with his “Friends of Angelo” program. And really, that’s the most important thing here, isn’t it?

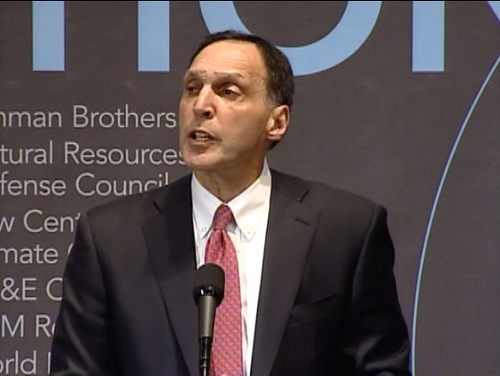

8. Dick Fuld

Image: World Resource Institute Staff/Flickr

How is it possible for a company to go bankrupt at the same time the CEO takes home $75 million over a two-year period? Talk about a disconnect. The bankster we are referring to is Lehman Brother’s CEO, Richard “Dick” Fuld, Jr.

Dick helped Lehman’s bankruptcy along when he just couldn’t give up control and sell the company when legitimate offers were on the table. He could have saved both the company and tens of thousands of jobs.

For his ineptitude, Fuld earned the Financial Times’ 2008 “Overpaid CEO of the Year” award.

7. Raymond W. McDaniels, Jr

Main Street: Joe the plumber buys a house, perhaps that he would ill-afford, loses his job, defaults on his mortgage and has to foreclose and overnight his credit rating drops. He is, in a word, screwed. Nobody is ever going to loan him a dime again.

Wall Street: Fortune 500 company gets greedy, starts screwing with its customers, stock plummets, lays off people, staves off bankruptcy by accepting a bail out from the Feds. Do you think their credit rating suffers? No, because the CEOs are in bed with the chief at Moody’s, Raymond W. McDaniels, Jr.

Would it surprise you to know that all those banks that received bailouts maintained their AAA credit ratings?

It’s also interesting that Warren Buffett, head of Berkshire Hathaway, is Moody’s biggest shareholder. And on the day Moody’s received a Well’s notice from the SEC, McDaniels sold $4.3 million worth of Moody’s shares. A week later Berkshire Hathaway sold a whopping $30 million worth of shares. It’s one of those things that make you go “hmm.”

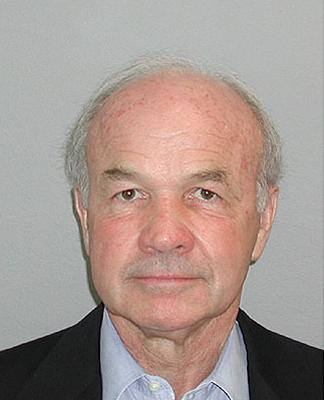

6. Ken Lay

It’s not often that someone is arrested for something other than murder, and the bail is set for $500,000. Federal prosecutors made a special exception for former Enron CEO Kenneth Lay when they handed down an 11-count indictment.

Lay was the epitome of the “Crooked E.” He set up fictitious companies to hide over $1 billion in debt. He also used an elaborate scheme that involved defrauding several banks, including Bank of America, to essentially steal employees’ retirement money. He continued telling his 28,000 staffers that there was no reason to panic and that they were sufficiently liquid. In the meantime, he sold off 918,000 shares to save his rawhide.

After his arrest, Lay offered these words: “I continue to grieve, as does my family, over the loss of the company and my failure to be able to save it. But failure does not equate to a crime.”

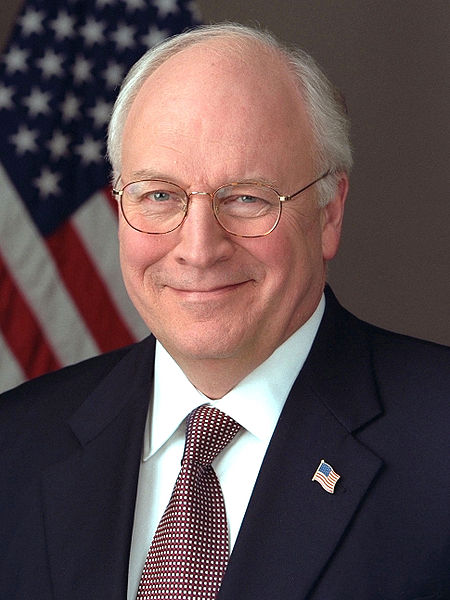

5. Dick Cheney

What happens when a subsidiary of your company, located in the Cayman Islands, opens an office in Tehran, Iran? You know that your company, which is based in the US, can’t do business in Iran. It’s one of those countries with links to terrorism. The Feds strictly frown upon this kind of thing.

Your company is also under suspicion for bribing Nigerian officials in a natural gas project you’ve got a stake in. You’ve spent $11 million housing employees at the Kuwait Hilton. A bad merger under your current CEO’s watch is considered one of the worst in energy company history, and made you inherit 70,000 asbestos claims.

If you’re smart, you realize your mistake and get rid of your CEO, right? Well, Halliburton didn’t have to do the dirty work of firing its CEO, Dick Cheney. Instead, he got pawned off on the people of the US when former President George W. Bush picked Cheney to be his running mate.

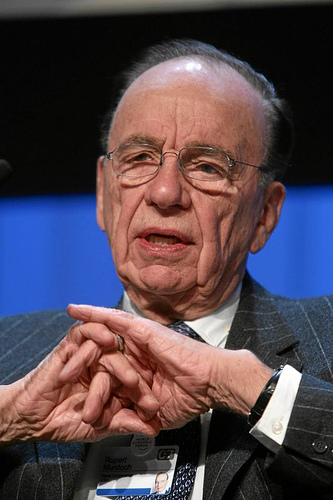

4. Rupert Murdoch

Image: World Economic Forum/Flickr

Depending which side of the political fence you tend to lean, you either find Fox News to be a credible news source or tabloid journalism. Depending on which commentator’s program you’re watching, Fox can be downright inflammatory and, at times, bigoted. You’d think that the head of Newscorp, which owns Fox, might find this deplorable.

But Robert Murdoch, owner of Fox News, thrives on it. He has been since he bought his first newspaper, Britain’s “The Sun,” in 1982. His first headline read “Gotcha!” across the paper’s front page after the Argentinian cruiser General Belgrano sunk.

“Gotcha” is also something the Feds wish they could say about Murdoch, who has made over $20 billion, but has managed to avoid paying net corporation tax.

3. Lloyd Blankfein

Although the media and statisticians have been citing tenuous “green shoots,” the Great Recession still seems to be chugging at full force. Unemployment, for example, is still hovering around 10% or higher. At the same time, through some mysterious deep-sea voodoo, Goldman Sachs posted a 4th quarter profit of $4.79 billion in 2009. Employee salaries averaged $498,000, up from $317,000 in 2008.

How did GS’s CEO Lloyd Blankfein do in 2009? His bonus was $9 million as compared to the $15 million odds betters were predicting. Anyone want to take a stab at what his salary was?

The basset-faced CEO was quoted in November 2009 as saying that he considers himself doing God’s work. He’s certainly garnering godlike payoffs, but I doubt the Guy in the Sky would approve.

2. Don Blankenship

Image: Coal Country

Putting profits before your employees is hardly unique in corporate America, regardless what industry you work for. But business decisions like that don’t generally result in anything more than disgruntled staff members. Some CEOs, however, get so greedy that they ignore the safety of their employees. To the point of killing them.

Unless you worked for Massey Energy, you may never have heard of the company or its CEO Don Blankenship. But since April 5, 2010, he’s no longer anonymous. And unfortunately for Blankenship, his name will now forever be linked with the mine explosion that killed 25 people.

Prior to the explosion, Blankenship regularly came to blows with the union that represents the miners, the association that regulates coal mining and the AFL-CIO for routinely ignoring safety concerns pointed out to him.

It’s too bad people had to die to get him to act.

1. Tony Hayward

Image: World Economic Forum/Flickr

“I think the environmental impact of this disaster is likely to have been very, very modest.”

“What the hell did we do to deserve this?”

“I would like my life back.”

“I’m a Brit. I can take it.”

These illustrious quotes belong to Tony Hayward, BP CEO and master of bad PR. He uttered them after the most disastrous oil spill in US history. It’s no wonder BP pulled Hayward off Gulf spill duty after his fifth or sixth PR gaffe.

Hayward’s recent participation in a yacht race and the fact that he sold 1/3 of his BP shares several weeks before the Deepwater Horizon explosion don’t exactly add to his glamour.