As an aspiring small business owner, you’ve got so many ideas. Why start just one small business when you could launch a whole series of them?

If you’re considering your options for multiple business ventures or investments, “What is a series LLC?” is only the first question you should ask.

There is a lot more you need to know to figure out whether a series limited liability company (LLC) is right for you. That’s why we’ve covered all the bases, from the definition and purpose of a series LLC to the pros and cons of creating one.

Defining Series Limited Liability Company

Series LLCs can get a little complicated, so let’s start with the basics. First, LLC stands for limited liability company. This is a type of business structure that one or more owners, or members, establish to separate their personal liability from that of the company, making it its own legal entity.

In general, LLCs are popular among small business owners because they use a comparably simple business structure and allow for pass-through taxation. Rather than having to file a separate corporate income tax return, the members of an LLC simply pay the company’s taxes as part of their personal income tax.

What happens if small-business owners want to operate more than one business? Well, they could go through the whole process of setting up an LLC all over again—and again, and again, and again. Another, and in many cases better, option is to form a series LLC. A series LLC is a business structure that builds on the concept of a limited liability company to create a protected series of individual business entities.

What Is the Difference Between an LLC and a Series LLC?

At its most basic, what separates a series LLC versus a traditional LLC is that a regular LLC is one distinct business entity, while a series LLC is a cluster of separate legal entities formed under one parent LLC.

What Is the Purpose of a Series LLC?

A series LLC establishes separate individual limited liability companies under one umbrella company. By setting up each company as a separate entity, you are keeping each business venture legally separate from the other companies within the series LLC.

The Parts of a Series LLC

The umbrella company used to establish a series LLC is sometimes called the “master LLC” or “parent LLC.”

Underneath this master LLC, you can create separate sub-LLCs. Each of these sub-LLCs counts as an individual series within the master LLC (and can be identified, besides their LLC names, as “series 1,” “series 2,” and so on). These different companies can also be referred to as “cells” or even a “child LLC.”

You don’t have to know when you first form an LLC how many series LLCs you intend to establish. You may start with the master LLC and then add one series and then another as needed.

The Rationale Behind Forming a Series LLC

Why would you want to set up your businesses as legally separate entities instead of co-mingling their assets and operations? While it may sound a lot simpler to manage one business instead of a series of individual companies, there are perks to forming a series LLC.

Series LLC Benefits and Drawbacks

For series LLCs, the benefits—beyond the benefits of regular LLCs—mostly revolve around liability protection, although small-business owners may also have an easier time setting up new LLCs than if they had to start from scratch.

The biggest drawbacks include differences in series LLC recognition across state lines and legal uncertainty stemming from the comparative newness of the series LLC business structure.

The Advantages of Setting Up a Series LLC

Liability Protection With a Series LLC

The primary reason small-business owners form a series LLC is to protect each of their business entities, ventures, and investments from liabilities posed by the owner’s other companies.

Debts and lawsuits are part of doing business. If an LLC takes on too much debt, it can go under, forcing owners to declare bankruptcy and close their business or sell them. The same could occur if the LLC gets hit with a devastating lawsuit, fine, or other type of financial liability.

Imagine that you kept all of your business ventures under one LLC and one part of that venture—one location, one type of service or product, one investment property—ran into financial trouble. That one aspect of your business could wipe out your entire company and your investment in it. The rest of your business assets could be taken to pay a lawsuit or debt against a totally different part of your company.

Even if the damage isn’t enough to take out your business entirely, it could still strip away resources from company locations or ventures that are thriving.

What a series LLC provides is liability protection. Because each individual series is its own LLC, all of your businesses would be recognized as separate legal entities. At least in theory, a creditor or a plaintiff in a lawsuit against one series couldn’t go after assets from your other series LLCs.

Easier Business Formation

Starting an LLC can be a time-consuming process, especially when you’re new to entrepreneurship. The process can be a bit simpler when you’re adding new cells to a series LLC. Depending on the requirements where you form your series LLC, you may only be required to register the master LLC with the state.

Even if you are required to register each cell with the state, the process for doing so is often less demanding. You may already have a service or an attorney to turn to or a template to draw from for your subsequent operating agreements or formation documents. Handling the administration of a series LLC is more streamlined than if you had to oversee the administration of a set of completely separate regular LLCs.

Problems With Series LLCs

Series LLC Recognition by State

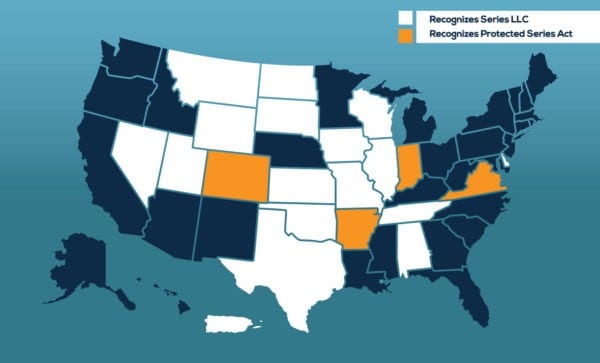

One of the biggest problems small-business owners run into with series LLCs is that not all states in the United States allow series LLC registration. Even among states that allow series LLCs, states may differ in how they handle liabilities, tax obligations, and operating requirements of series LLCs.

As of early 2021, states and U.S. territories that recognize some form of series LLC or protected series (under the Uniform Protected Series Act) include:

- Delaware

- Nevada

- Oklahoma

- Tennessee

- Texas

- Utah

- Illinois

- Iowa (Protected Series Act)

- Alabama

- Indiana

- Arkansas (Protected Series Act)

- Montana

- Kansas

- Missouri

- North Dakota

- South Dakota

- Nebraska (Protected Series Act)

- Wyoming

- Wisconsin

- Virginia (Protected Series Act)

- District of Columbia (Washington, D.C.)

- Puerto Rico

States that don’t allow the formation of a series LLC may still recognize the entity if formed as such in another state. For example, a series LLC may do business in California and be recognized as a series LLC there, even though businesses can’t be registered with this formation in the Golden State.

Not only is establishing a series LLC not an option in certain states, but the protection afforded to you by your series LLC structure may not apply in states that don’t recognize the series LLC concept. If you establish your business as a separate entity using a series LLC structure but you do business in a state without series LLC laws, tread carefully and consider speaking to a business attorney.

Legal Questions Raised by Series LLCs

Series LLCs are relatively new types of companies. Delaware, the first state in the U.S. to allow series LLCs, only began doing so in 1996, according to the American Bar Association. Between its comparably recent inception and states’ differing recognition of this business formation, the legal ramifications of using series LLCs aren’t always clear-cut.

Why a Series LLC Appeals to Real Estate Investors

Series LLCs are particularly popular among real estate investors who rent out real estate properties or “flip” homes to sell them at a higher value. Risks accompany each real estate investment you make. Each property you own could potentially catch fire, flood, develop mold, be damaged by a natural disaster, or face any number of other possible problems.

Although there are steps you can take to minimize the risks of these crises occurring and the financial fallout if they do, an unexpected crisis could be a death blow to your investment. If all of these investment properties are managed under one LLC, the stakes are even higher.

Suppose the damage to one property is so extensive that it wipes out your investment in that property and leaves you in the red. That property could take your other investment properties down with it, forcing you to reallocate funds from other properties to pay for cleanup and repair, or potentially have to sell those assets.

Real estate investors often use a series LLC structure to prevent this overlap of liability between their properties. If you establish each property as a separate entity, you can’t be forced to sacrifice one to pay for the debts accrued by another.

Forming a Series LLC

How do you form a series LLC? Generally, small-business owners looking to form a series LLC must follow the same requirements for establishing a regular LLC, according to state law.

Although these requirements vary from state to state, they’re likely to include:

- Composing a written operating agreement

- Filing your Articles of Organization, Articles of Formation, or Certificate of Organization with the appropriate state official or department, often the secretary of state or Department of State

- Designating a registered agent to receive mail and legal documents on behalf of your business

- Paying all required fees, including any franchise tax applicable to your business

To move forward with forming a series LLC, there are additional steps to take. First, you must make sure your state recognizes series LLCs and find out what’s required to do so. In some states, starting the process of establishing a series LLC is as simple as adding language allowing for the creation of protected series to your master LLC’s operating agreement or Articles of Organization. Other states may require you to fill out a separate form.

If you have already established your company as a regular LLC, you may be able to turn it into a series LLC by filing an amendment to your Articles of Organization or your operating agreement.

Since each series LLC within your master LLC is a separate business entity, you need to treat them as such. Each of your LLCs should have its own bank account containing only its own assets—never those of other LLCs in the series. Some states require small-business owners to select a separate registered agent for each LLC in a series.

Conclusion: What Is a Series LLC?

Now that you’ve gone from wondering what a series LLC is to understanding the advantages of this LLC formation, it’s time to think about what you want. A series LLC might not be an option in all areas or for all ventures, but it can offer your members more liability protection and more streamlined administration than you’ll find in other business structures.

LLC Resources

How to Start an LLC in California

How to Start an LLC in Florida

How to Start an LLC in Texas

How to Start an LLC in New York