We chose QuickBooks as our overall best paid accounting software for small businesses; so we did we add a final category for the best paid accounting software for the smallest businesses? In the main it’s all about cost control; while QuickBooks is awesome there’s a sliding scale of fees which can make it quite expensive in certain instances – there’s no such thing with Zoho Books; a single fixed fee of $24 a month gives you access to everything they offer, all the time.

Why Did We Choose Zoho Books?

There were a fair number of factors which led to our recommendation of Zoho Books online including:

Reputation

Zoho has been in business for 20 years and that’s an encouraging sign that they aren’t a flash in the pan and will be available to support your business and your accounting work for years to come. It also has a great reputation for spending the majority of its revenue on redeveloping and developing its products; which means that they won’t be standing still with Zoho Books but rather keeping it up to date and as useful in the future as it is today.

Cost of Use

While it’s not the cheapest software on the market – you can get Wave Accounting for free or licenses for QuickBooks from $9.99; it is the cheapest software when you want unlimited everything on the account that is invoicing, users, vendors, budgeting, etc.

With Zoho Books you pay $24 a month and that’s it and in exchange you receive the highest level of service with no limits on anything. If you’re not sure whether you’ll get enough use out of your accounting software to justify this – there is a 14 day free trial. We like the fact that there’s no requirement to input credit card details to access the trial.

It’s Easy to Use

But how does Zoho Books measure up when it comes to ease-of-use? The good news is that it’s incredibly simple to use and again, you can always take a free trial to test this for yourself.

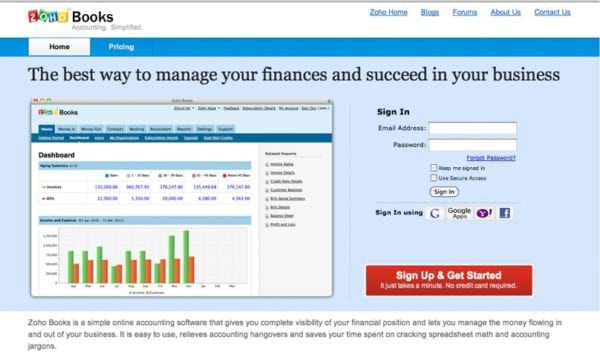

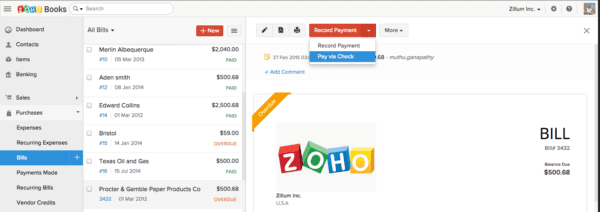

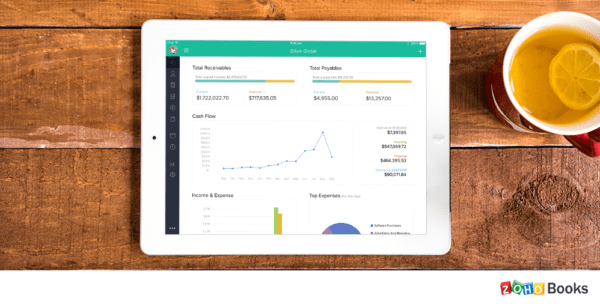

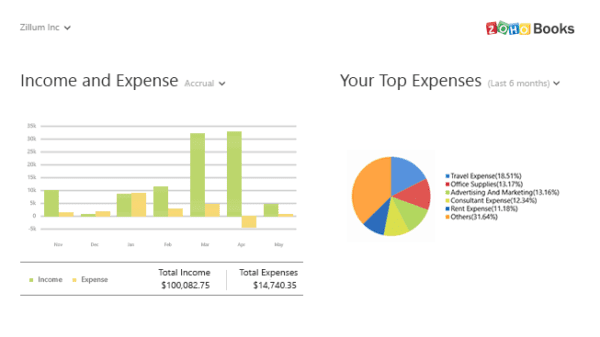

It’s very fast to set up a new account and as with many of our best accounting software picks; it delivers a nice, clean dashboard and menu system that allows you to get useful information without running reports as well as making navigation of the system as simple as possible.

Customizing that dashboard is easy too with a host of widgets that you can use to deliver the most relevant data for your business such as income and expense reporting and bank and credit card details.

This is also true for their mobile app, though it’s worth noting that like many accounting software providers – there’s only support for iOS and Android. Blackberry and Microsoft users are going to have to choose a different package if they need access to their accounting software on their handset. We don’t see this as a huge problem for the moment as both these operating systems account for a tiny number of users. It may be that Windows makes a fight back over the coming years but until it does; it’s pretty much an irrelevance for most mobile users.

There’s Plenty of Task Automation

The biggest need of a small business person from an accounts package is that the software does most of the work for them. That leaves them free to get on with their business rather than spending their lives on financial management.

Zoho Books is great for this. You can link it to your financial accounts such as your bank and PayPal. You can set up online payment for invoices – making it easier to get paid. You can track invoices and unpaid invoices. Most importantly; you can automate all of your workflow so that you can track all your data in real time, all the time.

Customer Support

Zoho Books offers some of the best customer service hours of any software vendor and it claims to provide telephone support and e-mail support 24 hours a day, every day of the year. This is in direct contrast to some of the other software providers who prefer to operate on EST business hours on weekdays only.

However, when you try to reach Zoho Books – you are subjected to an automated call queue which involves pressing lots of buttons. If you can’t get through to somebody quickly; you’re transferred to an answer phone to leave your details for a callback. We quite like this idea as it does mean you don’t have to hang on the line for ages but at the same time; it would be nice if they specified when you would get a callback. A 24/7 call center has a lot of working day.

Our experience of the helpline says that their staff is knowledgeable about the product and can walk you through a series of sensible queries in relatively short order.

The Limits of Zoho Books

We like Zoho Books very much for its all-inclusive fee. However, we also have to say that Zoho Books is, in some ways, more limited than QuickBooks and some of the other providers of accounting software for small businesses.

The lack of payroll services is a bit annoying. While for solo-preneurs and freelancers this won’t be a big problem – it may be an issue for businesses that are expanding. Given that payroll is often an expensive addition to other accounting packages; this is one of the reasons that Zoho Books monthly fee is so low.

It also fails to integrate with very many 3rd party applications which can be a deal breaker for those with an established suite of business productivity and payment apps that they intend to use. Zoho does, however, offer in many cases its own version of these services and the company has a good choice of applications that it offers. Remember though that tying all your services to a single vendor may not be a good thing in terms of your business risk profile.

Summary

Zoho Books is a good choice for the smallest of businesses. It’s our best accounting software pick at this end of the range because of its fixed monthly fee to get the maximum level of access. It satisfies our ease of use, reputation and customer support criteria too. The only major drawbacks are lack of payroll services and 3rd party application compatibility. We highly recommend Zoho Books as the best accounting software for the smallest businesses on this basis.